Hedging USDMXN FX risks:

USDMXN has declined from the highs of 19.5174 to the current 19.0791 levels, loss of almost 7.4% in just two and half months and technicals are indicative of further dips in the days to come.

Well, it would be wise to contemplate both above fundamentals and technical indications of an extensive bearish trend of USDMXN and married puts are recommended to the existing spot long exposures of this pair in order to hedge the further potential slumps of this pair.

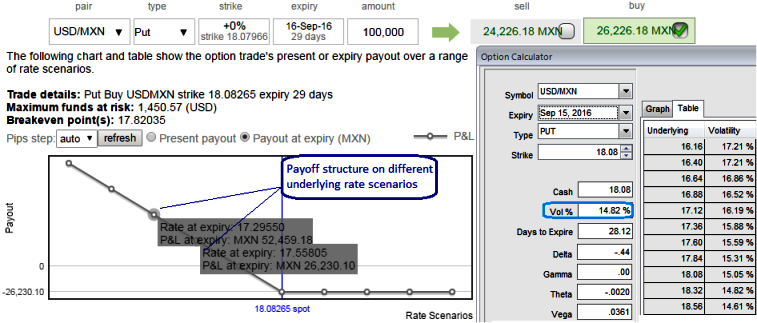

So, as shown in the diagram, this is the option strategy in which the Mexican foreign traders who have their dollar receivable exposures are suggested to buy an at the money put option of 1m tenors while simultaneously buying an equivalent notional amount of the underlying spot FX.

Since purchasing a protective put gives you the right to sell underlying pair at a predetermined strike price, there wouldn’t be any potential threat for this exposure regardless of underlying spot rates.

At times, just in case the option obligation is not to be exercised, this can also be utilized with a view to speculate by gaining the difference in option premiums as the IVs keep spiking the vega would resultant change in the premium increase (you can observe that in different rate scenarios).

1m ATM IVs are trending above 14.80% which is quite conducive for option holders when underlying spot keeps plummeting in next 1 month, this is evident in payoff structure during various underlying rate scenarios.

The strategy is typically employed when the foreign trader is having exposure on the dollar receipts, and he doesn’t want to take any FX risks, but wary of uncertainties in this span of one month.