In mid-August, the Mexican central bank somewhat surprisingly for many lowered its key interest rate. The accompanying statement contained no indications as to how monetary policy would continue. The minutes of the meeting show that the central bankers agree that there are downside risks with regard to the economy.

On the other hand, there is no agreement on inflation risks. The forecast uncertainty is regarded as quite high. Not everyone sees the risk for inflation as pointing downwards. In addition, the central bank expressed surprise that inflation expectations have remained stable and have not declined in line with the weak economy and declining inflation rates.

In this context, the focus is on today's inflation data release for the month of August. If this continues to weaken, this would argue for a further rate cut this month.

However, if it surprises significantly upwards, the sceptics in the board could gain the upper hand. External factors are currently dominating the Mexican peso. But if the central bank becomes increasingly dovish, the peso is likely to become more susceptible to risk-off phases.

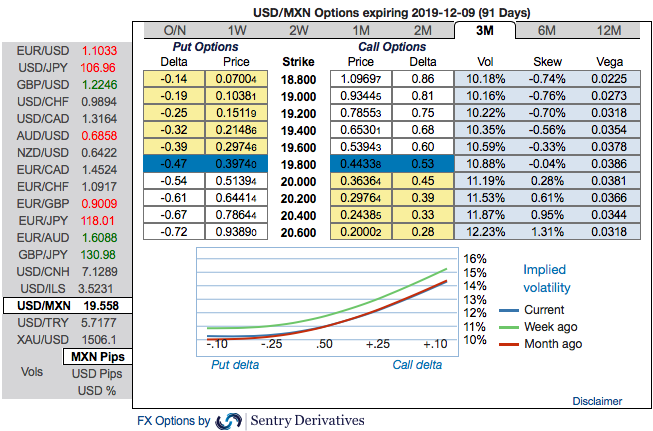

Technically, USDMXN major uptrend remains intact despite some minor corrections (refer above technical chart). We maintain MXN projections of 22 for the end- 2019 and our long USD recommendations in options. The peso’s high carry is likely the reason for MXN’s outperformance this year among EMFX peers. Yet, extended MXN longs positions, BoP weakness, political uncertainty and some fiscal deterioration in our view make MXN more likely to weaken for the rest of the year.

Of late, MXN seemed to be extending recovery threatening upper bound of the recent range.

But please be noted that the 3m USDMXN implied volatility skews signal continued upside risks. The previous massive sell-off of Mexican peso caused a vol surface dislocation, nudging skews to the highest since the 2016 US Presidential elections. Delta hedged 1*1.5 ratio call spreads exploit the dislocation while also having historically offered a superb performance. +1Y/-3M calendars of risk reversals take advantage of the lagging back-end vs front-end implied skews, spot reference: 19.50 levels. Courtesy: Commerzbank, Sentry & Tradingview.com

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays