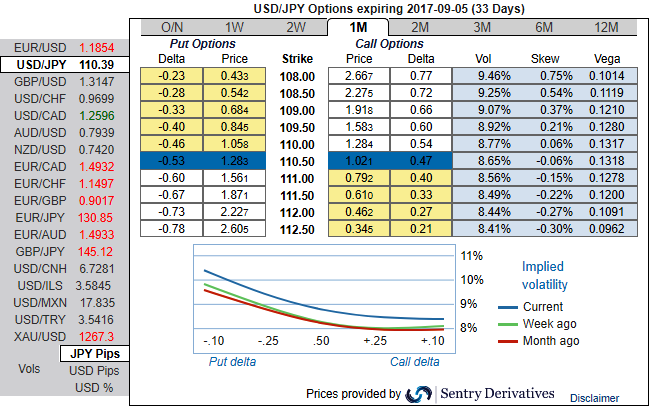

Please be noted that the positively skewed IVs of USDJPY of 1-month tenors signify the hedgers’ interests in OTM put strikes of 108 marks. While delta risk reversals have been flashing up the bearish neutral numbers, thereby, the underlying spot is deemed to be a weaker pair and needs systematic hedging vehicles to arrest this bearish risk.

USDJPY has been the clear G10 laggard in the ongoing bout of dollar weakness. But that can change in coming weeks as rising political pressure on PM Abe is raising the specter of the end of Abenomics, and with it, a potential appreciation of the yen.

On the flip side, the US central bankers simply seem reluctant to come to the aid of the USD at present. In view of the previously weak US inflation levels, Loretta Mester is lowering her expectation of the natural US unemployment rate. John Williams is “frustrated” about the inflation development in the US. And James Bullard has spoken out against further rate hikes short term in view of the weak price pressure.

JPM team estimates that USDJPY could fall to 102-108 in the immediate aftermath of Abe's resignation if indeed it comes to that the end of Abenomics. Even absent domestic Japanese political stress, there are other channels via which USDJPY could sell off, such as prosaic cyclical dollar weakness and/or an intensification of Washington dysfunction leading up to the debt ceiling debate in the fall.

Speculative positioning is extremely short the currency (near 10-yr lows on IMMs dating back to the Abenomics’13) and macro investor interest over the past month has moved in the direction of yen selling to play BoJ vs. rest of the world monetary divergence, hence decent odds that dips in USDJPY below YTD lows can spark a wave of unwinding.

We had recently flagged that USDJPY risk-reversals were looking rich (USD puts/JPY calls overly bid), and that still remains the case despite some correction this week (chart. Rich USD put skews make for attractive pricing on USD put/JPY call spreads to play yen strength; we favor RKI versions of vanilla spreads (knock-in on the short strike) to extend participation in spot sell-offs that can intensify if an Abe resignation becomes reality, for relatively little extra premium spend.

For instance, 3M 109 vs. 107 with 105 RKI USD put/JPY call spread costs 53bp (spot reference: 110.383), only 5-6 bp more than the vanilla version but with 2 additional big figures of participation, with maximum gearing ratios of 3.5 times if the barrier triggers and 7.2 times if it does not.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential