We all know that there exists positive correlation between CAD and crude oil prices, this week’s report was bearish for crude but bullish for gasoline and distillate.

This week’s report was bullish for crude, neutral for gasoline, and bearish for distillate. Total commercial crude and refined product stocks were flat at 1259.7 Mb, but the surplus to the 5y average rose 4.1 Mb WoW to 92.4 Mb, because total stocks normally decline this time of year. On a 4w av. basis, product demand growth was weak - almost flat - rising by only 18 kb/d YoY to 19.88 Mb/d (+0.1% YoY).

Although last Thursday's spill and shutdown of the 590 kb/d Keystone pipeline from Alberta to Cushing did not appear to have much impact on this week's figures, this will probably change in the coming weeks. Yesterday, the operator said that deliveries will be cut by 85%, or around 500 kb/d, through the end of November.

OPEC is scheduled to meet on November 29th, when the producer club is expected to decide whether to continue output cuts aimed at propping up prices.

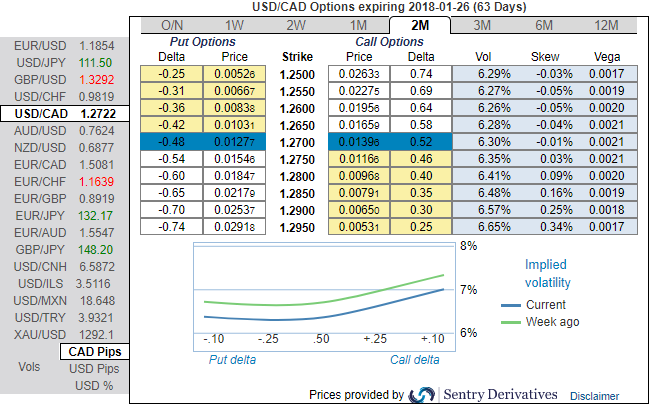

These developments are factored in OTC markets. Most importantly, please be noted that the ATM IVs of USDCAD is the least among G7 FX space, also be noted that the positively skewed IVs of 2m tenors are stretched to bid OTM calls strikes upto 1.2950. While risks reversals of this tenor are still indicating bullish risks owing to the above-stated risk events.

Thus, we advocate buying USDCAD 3m risk reversal strikes 1.3440/1.2450 (at spot ref: 1.2725).

The recommended skews and risk reversal structure (refer above nutshells) takes direct advantage of the cheap skew opportunity.

It is expected that any CAD downside to be volatile, as it would likely be caused by geopolitical tensions and/or market unwind. This justifies owning topside convexity and volatility. Pure volatility investors may implement active delta-hedging to get direct exposure to the skew while getting rid of the directional risk. Given the downside risks attached to CAD appreciation, we would advise directional investors to implement a delta-hedging strategy involving a negative pre-defined mark-to-market threshold.

Risk profiling: Unlimited below 1.2450, investors face unlimited risk if USDCAD trades below the 1.2450 strike in three months.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -67 levels (which is bearish), while hourly CAD spot index was at shy above -30 (which is bearish) while articulating (at 07:26 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?