Natural gas is currently trading at $2.83 per MMBtu.

Key factors at play in the natural gas market –

- The price of natural gas is likely to appreciate further. The current rally has the support of $2.75 area. The last rally, which had the support of $2.5 per MMBtu area faded around $2.9 resistance area.

- However, lower global price is likely to exert downside pressure. Price in the UK declined to 37 pence per therm, down from record 84 pence.

- Qatar has significantly increased investments in natural gas after it moved out of the OPEC cartel.

- Watch out for U.S. gas replacing Russian turbines in Europe. Due to pressure from the United States on European allies, Russian gas exports to the EU showing signs of a slowdown.

- Chinese demand in the coming years would be one of the most crucial factors. Russia and Iran are likely to dominate the Chinese gas market, the fastest growing in the world.

Now, for the inventory,

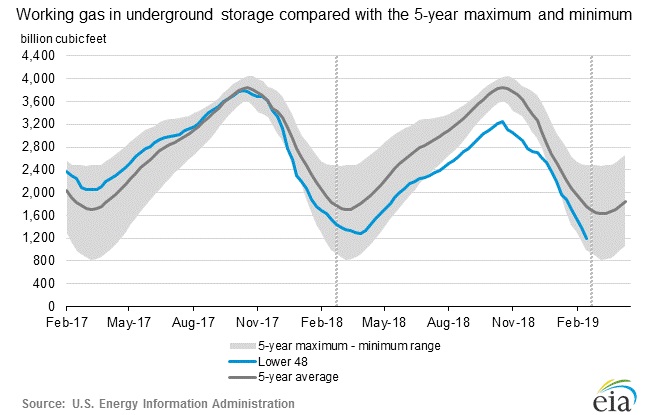

According to the latest numbers, working gas in the underground storage remains at 1.186 trillion cubic feet (Tcf). Stocks are 359 Bcf less than last year at this time and 569 Bcf below the five-year average. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory declined by 204 billion cubic feet against an expectation of 208 billion cubic feet decrease. Today 48 billion cubic feet draw expected.

- EIA will release the inventory report at 14:30 GMT.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed