As far as US monetary policy is concerned the US President is pushing the Federal Reserve into a corner with his constant criticism of its policies. Even if the FOMC was to lower the key rate purely as a result of inflation concerns at some stage, Trump would probably boast about this having been his achievement. Along the lines of “I have been saying for a while that interest rates were too high” - despite the fact that his protectionist monetary policy increases uncertainty, thus accelerating rate cuts as a kind of “pre-emptive insurance”. It is likely that Fed chairman Jerome Powell and his colleagues will want to avoid cutting interest rates for as long as possible so as to avoid giving the impression that they caved in under Trump’s pressure.

As a result, it is assumed that it will be too early for a rate step next week. The FOMC will prepare for a first-rate cut with the help of its forecasts, dot plots and statement next Wednesday and will then get active either in July, as the market now expects, or in September – depending on the data, i.e. depending on the next labor market report and the price data.

EURUSD prices have already sensed some sort of upside traction (the recent highs – 1.1347) but quickly rejected that bullish move. The decline has been impulsive in nature as we head into the Fed and as such indicates the rebound from 1.1107 is just another correction. Technically, any decline through 1.1220/1.1190 pivot support would support that outlook. On a broader perspective, the prices are within our 1.14-1.09 basing region. We still have little evidence of a major base at this stage, but continue to monitor closely.

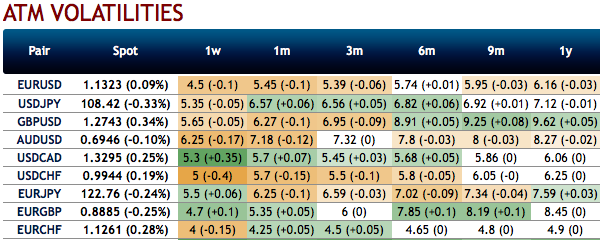

Most importantly, the FX OTC hedging markets are also suggesting the same thing, the shrinking IVs on lower side and risk reversals of the short tenors indicate interim rallies which is quite conducive for OTM put writers but the major bearish hedging sentiments remain intact.

Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above nutshell, 3m positively skewed IVs are stretched on either side (equal interest in both OTM call and OTM puts) that signifies hedging sentiments for both upside and downside risks.

To substantiate these indications, a positive shift in short-term and bearish neutral RRs (risk reversals) across long-term tenors, which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write a (1%) out of the money put option of 2w tenors.

Alternatively, the dubious bulls but with hedging grounds can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix, Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 4 levels (which is absolutely neutral), while hourly USD spot index was at 96 (bullish) while articulating (at 08:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?