The US cyclical boost is not enough to warrant a change in the bearish dollar view unless global growth slows. A universal financial markets trade disarray head out by a worsening cross-boundary trade environment after the US decision to impose tariffs on Chinese goods and China's threat of a counterstrike.

The Trump administration announced its intent to impose trade restrictions on a number of products imported from China in retaliation for China’s intellectual property practices.

President Trump recently signed the proclamation on adjusting import tariffs by 25% on steel imports and 10% tariffs on aluminum imports on Thursday 8 March. Mexico and Canada have been exempted indefinitely for now, but conditional on a new NAFTA agreement. The proclamation also includes a potential for US entities to apply for an exemption. We think this could include the US oil and gas industry.

The Korean won’s weakness was noted on a plunge in the 3-month swap for USDKRW fell to -500 points after Wednesday’s FOMC meeting from -270 on 8th March.

While the Bank of Korea signaled no urgency to follow through on its last rate hike due to weaker-than-expected inflation.

On the other hand, as witnessed with NAFTA, the US is also seeking a better deal from Seoul in its renegotiations to update the Korea-US Free Trade Agreement.

Amid all these lingering news, one shouldn’t forget that the primary casualty in FX options markets of the stall in the weak dollar trend over the recent past is the fall-off in directional investor demand for USD puts that was so pivotal to the surge in front-end vols earlier in the year.

The bar for outright vol selling is considerably higher this year, but that does not preclude exploiting pockets of receding of dollar momentum to tactically harvest theta when curve shapes and realized vols co-operate. USDKRW is one of the best candidates to do so currently.

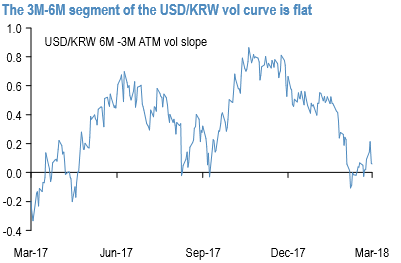

First, the 3M-6M segment of the KRW vol curve is flat (refer 1st chart), so naturally lends itself to short front vs. long back curve steepeners.

Secondly, KRW is one of the notable laggards in the normalization of FX vols from their VIX spike highs as discussed earlier, hence there is room for the front-end of the curve to sag.

Thirdly, realized vols in USDKRW have cratered over the past two weeks, and are now running a substantial 2-3 pts. under 3M ATMs (refer 2nd chart). Absent another SPX shock, subdued KRW realized vols can persist given tailwinds from equity inflows, the won’s trade-related appreciation bias and a more symmetric policy lean against bouts of sharp FX rallies and sell-offs.

Not surprisingly, the combination of high implied/realized vol ratios and a relatively tight 1050-1090 spot range this year also marks it out as one of the better range plays on our double no-touch (DNT) screens. The vanilla expression of the KRW calendar is a short 3M vs. long 6M vega-neutral vanilla structure.

For investors constrained from assuming uncapped downside risk in vanilla KRW options on geopolitical risk considerations, one-touch calendars are a viable alternative; for instance, short 2M vs. long 4M 1050 strike calendar spreads cost 19% at inception (spot ref. 1082) and roll up statically to 38% in unchanged markets (2X gearing), potentially even a fair bit more if spot were to slip lower towards the middle of its YTD range around 1090; the 1050 strike is also below the 1060 floor that official jawboning has placed under spot this year. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics