In longer dated vols, this week indicated that Taiwanese life insurance companies were actively extending the maturity of their FX hedges, Bloomberg reports.

Whereas in the past they had focused primarily on 3-month swaps—the vast majority of which are executed onshore — anecdotal evidence from the region indicated a growing preference for 1-year and potentially longer tenors.

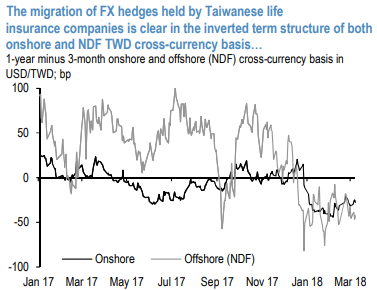

We can see evidence of this in FX forward pricing, where the term structure of both onshore and NDF cross-currency basis recently inverted (refer 1st chart).

Though not a regime shift by any means, such a change in hedging strategy is likely intended to mitigate the potential impact of Fed hikes on FX hedging costs. It is important to note, however, that with nearly 75% of our forecast for four hikes over the next year priced into the curve, barring a significant acceleration in Fed tightening we think 1-year maturities are unlikely to offer meaningful savings over rolling shorter-dated hedges.

Further, given more limited onshore liquidity in these points, they are exposed to the noticeably higher volatility exhibited by NDFs. In the meantime, given the relative slopes of the USD and TWD swap curves, carry on hedged foreign assets is likely to deteriorate as a greater fraction of their hedge book is pushed into longer tenors (refer 2nd chart). In fact, such a shift will likely make EUR-denominated assets—which already offer better relative value— look that more attractive by comparison. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data