It is generally assumed that the Bank of England will once again raise the upper limit of its asset purchases today. Considering the speed at which it is currently purchasing assets it would have reached the existing limit within weeks. An increase by approx. GBP 100bn would be sufficient to keep up purchases at the current rate at least until the next meeting in August. At the last meeting two MPC members had already voted in favour of raising the limit by this amount, which is why the market is even talking this sum. It is quite trivial: if the MPC decides on a higher amount, that would be a dovish signal, as the BoE would commit to continued asset purchases past the next meeting rather than waiting until then to take a decision. Sterling would come under pressure as a result; however not just because of the purchases in themselves, but also because that in particular would signal that the BoE prefers to do a little too much rather than a little too less. And that in turn might fuel speculation about negative interest rates.

More recently, rate expectations had risen again on the market, no doubt also as a result of a more optimistic economic outlook. However, the risk is high that the BoE will dampen these expectations by providing a rather dovish outlook, as the Fed did last week.

Brexit is being overshadowed, this is only temporary and GBP remains vulnerable from a great sense of realism amongst investors about the government's objectives for the EU trade talks and its credible threat still to walk away in the pursuit of regulatory autonomy from the EU and freedom from strict level playing field commitments. As a result of the Brexit-virus one-two we are lowering the GBP forecast.

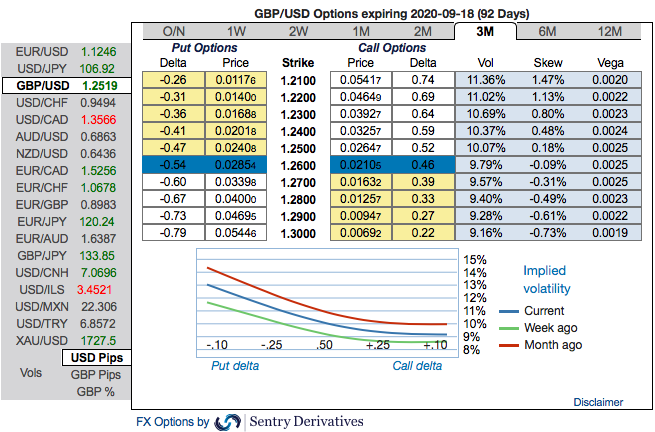

Options Strategy (Debit Put Spread): Contemplating above factors, wise to deploy diagonal options strategy by adding short sterling: Stay short a 2M/2W GBPUSD put spread (1.2650/1.14), spot reference: 1.2435 level.

The Rationale: Observe the 3m GBP’s positive skewness that has stretched towards OTM Put strikes upto 1.21 levels, hence, options traders are expecting that the underlying spot FX to slide southwards.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run. One can observe fresh negative bids that indicates hedgers have shown renewed interests for bearish risks in the months to come.

Hence, we advocate the diagonal options strategy on both hedging and trading grounds. Courtesy: Sentry, Saxo & Commerzbank

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts