Gold price seems to be the consistent standout under an investor positioning mean reversion rule with a success ratio of over 60% over the last five years and modest average monthly returns, albeit with a low information ratio.

Hedging Framework

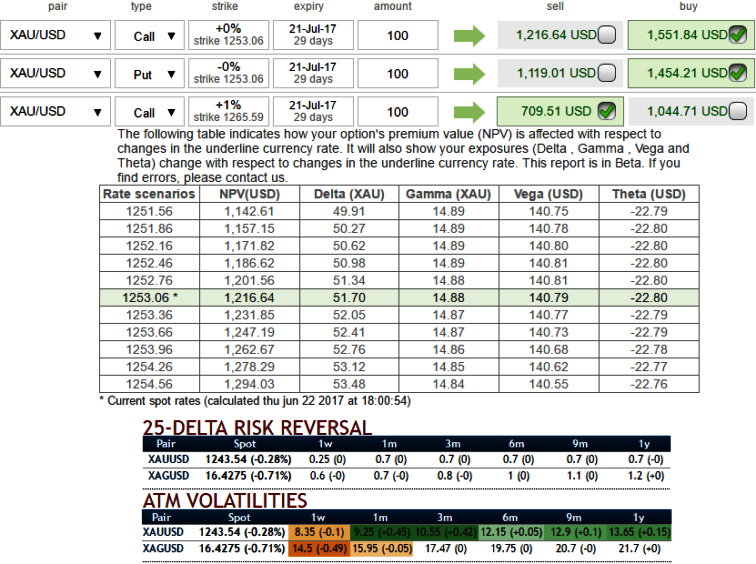

Strategy: 3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in XAUUSD 1M at the money vega put, long 1M at the money vega call and simultaneously, Short theta in 1m (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: The nutshell above explains that hedgers’ interests have been neutral but upside risks are lingering, however, no new shift in sentiments is observed. As a result, we don’t see much traction OTM calls. While 1m – 1y IVs spiking higher 9.25% to 13.65%.

As you could observe the vega of long leg (buy) call option position is 140.79 USD and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in the increase or decrease by 140.79 USD, respectively. The Vega of a short (sell) option position is negative and an increasing IV is bad.

Last week, the U.S. central bank raised interest rates for the second time this year and maintained plans to go ahead with another rate hike by year-end.

Despite the Fed's relatively hawkish message, market players remained doubtful over the central bank's ability to raise rates as much as it would like in the coming months due to a recent run of disappointing U.S. economic data and indications of weak inflation.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation