We structured a bearish AUDJPY view through a calendar spread of one-touches (short a 3m one-touch put, long a 6m) to capture the good-bad duality in Trump's policy platform. The markets have been squarely focused since the election on a pro-risk loosening in fiscal policy and corporate deregulation, but the positive impact on risk sentiment and cyclical crosses such as AUDJPY could yet be reversed should the new Administration deliver on its protectionist agenda and vacillate over fiscal reform.

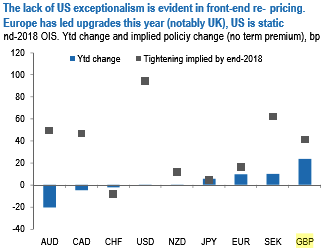

Aside from the broader risk backdrop, monetary policy developments have been modestly negative for AUDJPY insofar as AUD rate expectations have been under more negative pressure this year than any other G10 country (refer above chart).

This week's Q4 CPI data confirmed the disinflationary price dynamics that are a challenge to the RBA (trimmed mean inflation hit a new record low of 1.6%) even allowing for the new governor’s switch in emphasis from inflation to financial stability.

We continue to expect two more cuts from the RBA this year, albeit we have pushed back the first of these from February to May, around the expiry of this trade.

Short 3m/long 6m AUDJPY 78.0 one-touch puts in 0.69:1 notional for net premium 31.0%.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data