Today, the Bank of Japan has maintained the status quo, negative rates are kept on hold. The BoJ cut its GDP forecast for FY2018 ending in March from 0.9% to 0.6%, which is no surprise considering what looks like a weak Q1. In addition, FY2019 and 2020 GDP and inflation forecasts have been cut slightly. Particularly interesting is the new inflation outlook, which now includes FY2021. BoJ expects CPI inflation to hit 1.6% by then (lowest t+2 inflation forecast since 2013). That is, the BoJ does not expect to meet its inflation mandate within a two to three-year horizon.

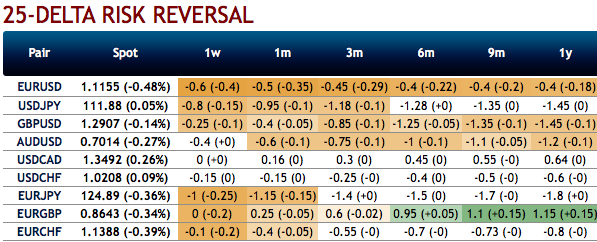

Risk Reversals Substantiate Skews (EURJPY): We could see the existing bearish neutral risk reversal set-up of euro crosses (especially EURJPY and EURUSD) that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Hedging skewness (EURJPY): Most importantly, to substantiate the above indications, please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 122.50 levels so that OTM instruments would expire in-the-money.

Options Trade Recommendation (EURJPY): We’ve advocated buying 3m EURJPY (1%) ITM -0.69 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier. If the expiry is not near, the delta movement wouldn’t be 1-point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Source: Sentrix and Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -47 levels (which is bearish), while hourly JPY spot index was at 160 (bullish) while articulating at (07:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures