The RBNZ has maintained the 'status-quo' in its monetary policy today. Kiwis central left the OCR unchanged at 1.0% at today's OCR Review as widely anticipated. The press release suggested that the RBNZ does not currently see a need to cut the OCR further. The overall assessment was that the outlook for monetary policy "has not changed significantly" since the August MPS. The RBNZ seems to be saying that its actions to date are sufficient. It noted that the OCR cuts to date have led to lower lending rates and a lower exchange rate; and, it expected low-interest rates to generate a pickup in domestic demand over the coming year.

We have remained short Antipodeans (both AUD and NZD) despite a lack of near-term local catalysts. We continue to maintain these recommendations but also increase AUD shorts via a bearish AUDJPY put spread this week. The primary motivation to increase AUD shorts is a shift in the RBA stance which indicated that the bar to cut rates has been lowered. At the recent minutes, the RBA made several surprising changes, which include conspicuously dropping the language around needing “additional evidence” to justify further cuts.

Quite a few economists perceive this as lowering the hurdle to easing policy further, and suggests less degree of patience from the Bank. The RBA has also increasingly acknowledged the influence from the global factors – both lower rates and global risks – as determining factors in the policy outlook. Taken all together, our economists have moved forward their expected 50bps of hikes remaining to October and February, from February and May previously.

The preferred way to increase AUD shorts is vs JPY as it would have the added benefit of being a hedge to US-China trade talks.

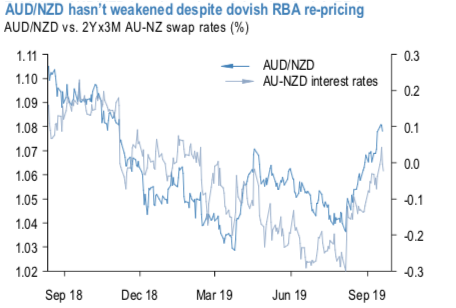

Given the lack of visibility on US-China trade talks and stabilizing data in the interim, we think that such a hedge is best positioned for via limited downside options (in this case a 3m put spread). We part finance this by selling AUDNZD topside as the cross is largely unchanged despite narrower differentials and growing expectations of RBA rate cut (refer above chart).

Trade tips:

Maintain shorts in NZDJPY via 6m put spread. Paid 1.07% initiated at the end of May. Marked at 1.79%.

Buy a 3m AUDJPY put spread (72.0/69.5) (spot ref: 73.2); sell a 3m 1.0975 AUDNZD call (spot ref: 1.0820). Paid 0.38%. Courtesy: JPM & Westpac

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields