The latest development of the yield spread between UST notes and German Bunds does not correspond to the development of EURUSD. Let us shed some light on something to this observation. We have commented before on the discrepancy between widening forward points in EUR-and EUR-crosses and relatively tame levels of vol in comparison, a combination that has resulted in an explosion in carry-to-vol ratios in these pairs.

For the FX market’s judgment what really matters is not so much the current fiscal stance, but the US political system’s general ability to adapt to the reality of unpleasant budget restrictions. The FX market is not likely to be interested in whether this “point in the future” is in 5, 10 or 20 years.

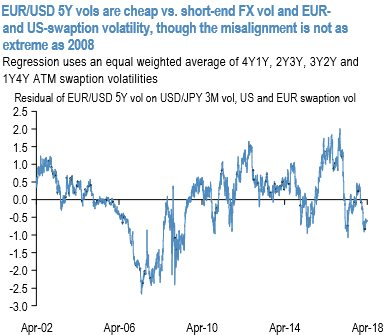

The difference with yen is that the mispricing of EURUSD 5Y vol relative to short-dated FX vol and the EUR and US swaption volatilities is not as extreme as in 2008 (refer above diagram) as is the case with USDJPY. In an ideal world, another 1-vol of additional misalignment would set-up excellent entry levels into outright vega longs.

There has been undisputable value in long-dated Euro vol in the light of these technicals, but we cannot help voicing some thoughts around the potential (or lack thereof) for it to truly gratify vol buyers through explosive spikes.

First, Euro strength has never really been a catalyst for higher volatility in the past since it typically tends to coincide with dollar weakness, which in turn is associated with plentiful global liquidity and search for yield. 2Q-3Q 2017 was an exception when 5Y ATMs rallied 1.5 vol trough-to-peak alongside a 10% rally in the currency, but the backdrop for that move was a one-time substantial French election risk premium in the Euro and clean spec positions that intersected with Draghi’s hawkish policy turn at Sintra, and led to a global macro scramble for buying EUR calls.

The medium-term rationale for a stronger Euro has not changed, but with the macro narrative, valuations and positions much more mature today than last year, a repeat of similar intensity directional option demand is lower odds from here. If the history of previous major Euro trends is any guide, lower premium limited upside option structures with small (maybe even negative) vega exposure are more likely to be favored by levered accounts who also have the added headache of higher forward points penalty to contend with currently –another change from last year’s near-perfect conditions for a spot rally.

Second, the carry to-risk template for EM currencies does not quite apply to the Euro, where the baseline macro view and investor positioning overhang is overwhelmingly in the direction of negative carry (long Euro cash or call options). If volatility is the outcome of leverage meeting shock, the potential for outsized moves appears far more likely if the market finds itself wrong-footed on the Euro view and is forced to delever consensus longs.

A dollar crisis precipitated by a sudden loss in confidence in the greenback as a reserve currency can deliver simultaneous EURUSD spot and vol rallies, but JPY with its well-worn anti-risk market sensitivity and a more entrenched structural short base through 20-years of carry investments is a better hedge for that state of the world. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts