The recent developments:

- The dollar slightly spiked today (DXY at 89.11), however, slumps well below 21DMAs, its slide on Friday to counter after a Thursday’s rally was major owing to the commentaries from Donald Trump.

- The mixed bag of actions in Asian markets.

- Futures pointed to an opening gain of 0.3% for the S&P 500.

The relationship between market volatility, stocks, and the dollar is seemingly complicated.

A gauge of benchmark expected stock swings, the CBOE Volatility Index, has begun zipping higher even as the S&P 500 has risen in January. Analysts and policymakers perceive that the correlation can't last forever.

The gauge, which is grounded on S&P 500 options prices, tends to rise when investors are jittery and stock markets are declining. It happens so regularly that the index, which trades under the ticker "VIX," has been dubbed the stock market's "fear gauge." But that hasn’t been the case this year.

The VIX has unusually stirred the same direction as the S&P 500 on over half of the trading days in January. The VIX has risen 4.9% this year and closed Thursday at 11.58, while the S&P has jumped 6.2%, in its best start for any year since 1987, according to The Wall Street Journal’s Market Data Group.

The DXY remains centered around the 89.00 area with gravity still expected to remain a threat to the index. Note however that potential trade tensions may also continue to lurk near the surface, with US President Trump highlighting “very unfair” EU trade policies over the weekend. With skepticism towards the dollar still significant at this juncture, investors may continue to disregard underlying dollar support stemming from rate differentials.

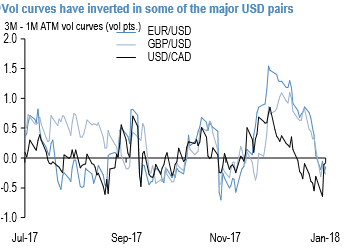

The eye-catching jump in front-end USD vols of late -VXY Global is up 0.7 % pts. from the middle of last week - has led to the inversion of vol curves in a handful of major currencies (refer above chart). Coupled with palpable anxiety around the longevity of the unusually swift dollar downtrend, this vol structure is motivating considerations of short front vs. long back USD put calendar spreads as theta harvesting overlays on dollar shorts.

We are not convinced about the advisability of such structures however when realized vols are a typically rising alongside a weakening dollar; the persistent forecasting error in recent weeks has been to underestimate the velocity of the dollar downtrend, and there is little evidence that consensus expectations have necessarily adjusted for these misses judging from the general surprise at yet another late-week drop in USDCNH.

The only currencies where one might consider sell/buy USD put calendars with some conviction are those where central banks have voiced concerns about FX strength and/or potentially defended a short-term floor (e.g. 1060 in USDKRW), but even there, powerful macro (trade-related appreciation pressures) and flow (equity inflows) forces could derail option constructs reliant on precise timing of spot moves. The safer call in our view is to focus calendars on non-USD-crosses where realized vols should remain contained on the view that USD-denominated correlations will stay elevated i.e. USD-moves will be broad-based whether the dollar sell-off continues or stages a sharp rebound; the resulting natural resistance to runaway spot moves should aid short gamma option constructs.

Anxiety around a sharp USD rebound can be hedged with highly geared USD calls in gold, AUD, and ZAR. Vol curves inverted in a handful of USD majors as front-end implieds spiked. Despite less attractive vol curve optics, we favor selling front/buyback calendar spreads in fundamentally sound non-USD crosses such as EURPLN & EURRUB that are less exposed to broad dollar volatility. Courtesy: JPM

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms