Before we begin with this write-up, we would like you to refer below weblink for our recent post that briefs about our hedging framework on this pair:

Well, mild upswings were foreseen and accordingly we’ve advocated writing overpriced puts. The underlying spot has acted as per our whim fancy and the short leg in our put ratio back spread has been functioning as anticipated, rest is history.

AUDUSD in medium term perspectives: Last week’s rebound off 0.7329 has been sustained, suggesting a push beyond 0.7420 today.

However, the modestly weaker than expected Australian CPI outcome has added yet another factor capping the A$: softer commodity prices; a more protectionist stance from US President Trump, and higher US yields if the Fed raises rates in June as we expect. These leave the A$ with strong resistance at 0.75. We expect to see it heading towards 0.73 by year end.

AU swap yields 1-3 month: Our RBA outlook (on hold for some time) is anchoring front end valuations. We expect 3yr swap rates to remain in a 1.9% to 2.3% range, with core inflation still below 2%

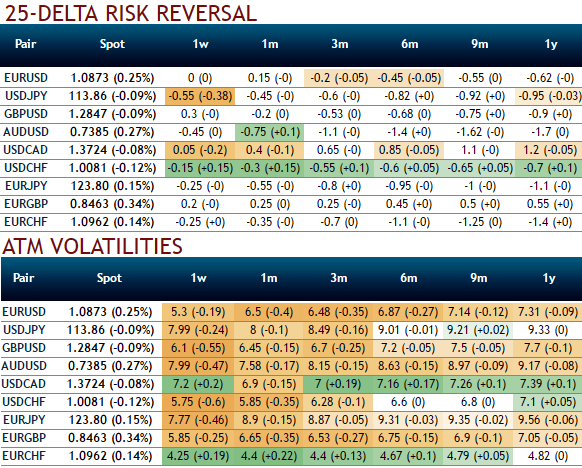

OTC tools signal for downside risks: Please be informed that from the above nutshell evidencing the positive change in delta risk reversals, while IVs are shrinking (for shorter tenors) which is conducive for put overpriced writers.

The negative risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests, which is in tandem with the above mentioned underlying forecasts of downside risks.

Hence, we still uphold our previous option trade recommendation on hedging grounds.

Weighing up above aspects, we eye on loading up with fresh longs for long term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

Thus, the execution of hedging positions goes this way:

Short 1w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data