AUDUSD contained in a 0.7600-0.7700 range. AUDUSD medium term perspectives: Although the pair bounces off the 0.7450, the upside area should be limited to 0.7600.

The modestly weaker than expected Australian CPI outcome has added yet another factor capping the A$: softer commodity prices; a more protectionist stance from US President Trump, and higher US yields if the Fed raises rates in June as we expect.

Further out, though, the underlying AUD trend should be gently lower, as growing bulk commodity supply gradually cools the 2016 price surge. Iron ore should be back under $80/tonne by June, with further (modest) declines likely in H2 2017.

These leave the A$ with strong resistance at 0.76. A steady hand from the Fed in June plus an optimistic RBA should limit downside on AUDUSD during the next few months. But we foresee it would be heading towards 0.74 by year end.

To substantiate the delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels.

OTC hedging arrangements for downside risks seems intact, you could make this out from the above nutshell evidencing risk reversals, while IVs are spiking higher (for 3m tenors) which is in tandem with the above mentioned underlying forecasts and its rationale.

Please be informed that the nutshell showing negative risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Please be noted that the 1w ATM puts are overpriced than prevailing implied volatility. 1w ATM puts priced 37% more than NPV, whereas 1w IVs are below 10%. Hence, amid bearish-neutral risk reversals with this considerable disparity between IVs and option pricing we see the ideal shorting opportunity for option writers in overpriced OTM puts.

Option Trade Recommendation:

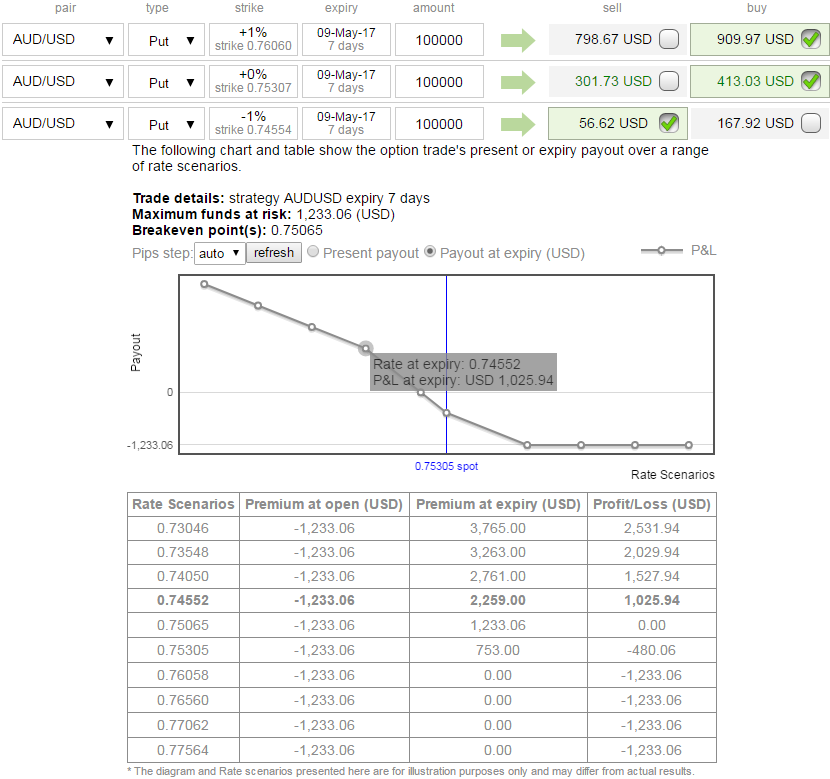

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry. Please be noted that the tenors shown in the above diagram are just for the demonstration purpose, use accurate tenors as stated here in this write-up.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation