The Bank of Canada is scheduled for its monetary policy meeting today, and most likely to maintain the status quo to leave its key rate unchanged. There would be no surprises on that front.

However, that does not mean that CAD traders can sit back and relax today. As is often the case the devil is in the detail: will the BoC stick to its view that further gradual rate hikes will be necessary for the future despite the fact that the Fed has now taken a neutral view? We assume so. Of course, Canada, too, is facing huge uncertainties for the outlook – such as the as yet unsolved trade conflict between the US and China as well as global growth concerns.

However, the BoC had started to hike interest rates later and more cautiously than the Fed, which reflected the much more immediate risk for the domestic economy as a result of the NAFTA renegotiations.

As a result, it still has some catching up to do. Most recently the BoC assumed that it still has scope for a few more cautious rate hikes until a neutral position is justified. Market participants are questioning this and are pricing in a further rate hike this year with only a small likelihood. So if the BoC once again confirms its expectations of further rate hikes CAD should benefit.

CAD OTC indications and options strategy:

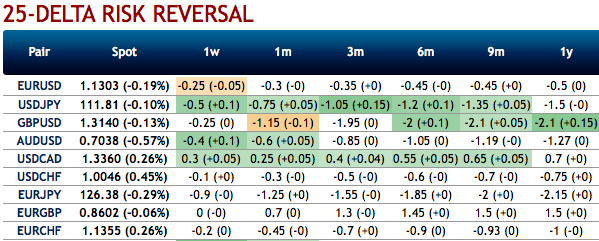

3M ATM IVs are trending a shy above 6.26% - 6.58%, skews are also suggesting the odds on OTM call strikes up to 1.36 levels at this juncture. We could also notice bullish neutral risk reversals that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favorable cost reduction.

At spot reference: 1.3360 levels, we execute USDCAD 3m/1m call spread with strikes of 1.36/1.32 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 36 levels (which is mildly bullish), while hourly USD spot index was at 118 (highly bullish) while articulating (at 11:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?