In this write-up, we emphasize on USD put/CHF call spreads and/or RKOs: Possessing standalone OTM USD puts/CHF calls seems to be an arduous proposition owing to the triple whammy of negative carry on points, the recent surge in short-dated vol and steep risk-reversals.

While riskies in most USD-majors have re-shaped in the direction of USD puts as the broad dollar has weakened, USDCHF is one of the most extreme examples of elevated USD put skews, which in turn results in one of the highest leverage ratios on USD put/CHF call spreads in recent memory (refer above chart).

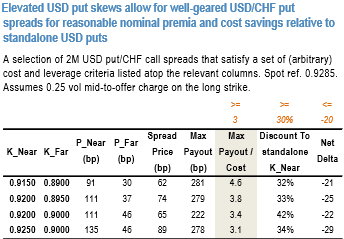

At current market (spot ref. 0.9285), a 2M USDCHF put 0.92 /0.90 USD put/CHF call spread costs 65bp, offers 3.4x max gearing and 40%+ cost savings relative to the standalone 0.92 strike vanilla call (refer above table for a selection of USDCHF put spreads with decent optics).

An interesting twist on bullish CHF structures is to consider alternative CHF-crosses such as AUDCHF and NZDCHF that avoid the dollar beta of USDCHF, yet offer useful anti-risk/anti-commodity exposure and are consistent with the baseline views of steady declines in both the antipodean currencies through 2018.

Net vega buying structures such as CHF call spreads also benefit from elevated AUD vs. CHF implied correlations i.e cheap CHF cross vols: the 2nd chart demonstrates that AUDCHF and NZDCHF implieds are priced 2-sigma cheap to historical norms relative to USDCHF and are primed to correct sharply higher if risk markets hit an air pocket.

For investors already short USDCHF in cash, short tenor USD put/CHF call reverse knock-outs (RKOs) with rebate can be a worthwhile levered overlay. RKOs exploit the same vol surface characteristics as vanilla spreads, but with much higher gearing.

Rebate RKOs repay the premium back if the barrier triggers, which is a useful feature to incorporate into option structures given that the market’s persistent forecast error through the dollar sell-off has been to underestimate the pace and extent of the move. Doing so ensures an asymmetric payout profile of either zero P/L in an aggressive CHF rally, in which case the underlying cash position should be outperforming, or positive P/L in moderate CHF rallies; the downside is the loss of only the small premium amount if CHF weakens.

At current market (spot ref. 0.9285), consider a 1M USDCHF put 0.92 strikes with 0.89 RKO with a rebate that costs 33bp and offers 10x max gearing.

Being a pre-Italian election expiry, 1M exposes the trade to less event risk and retains most of the premium value even after 3-weeks of the unchanged spot. Courtesy: JPM

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed