Hush-hush rumors or fact, but the Canadian officials perceive increased likelihood of the NAFTA negotiations waning out, leading the US to leave the trade agreement, dealt CAD and MXN a severe blow last night. While MXN was able to largely retrace its losses following denials from the White House that the President’s position had not changed, CAD is still trading at notably lower levels this morning.

Contemplating this, the Bank of Canada (BoC) rate hike at next week’s meeting less likely as a possible end or even just a curtailment of the NAFA agreement would have far-reaching effects on the Canadian economy. Now that it has become known that the NAFTA negotiations are not on a path towards success at all the BoC might refrain from further rate hikes so as to avoid putting additional pressure on the Canadian companies with higher interest rates and as a result a possibly stronger CAD.

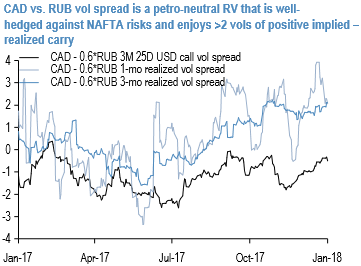

On a related note, we like relative value constructs with CAD or MXN vol as the long leg. One that looks interesting to us at present is a CAD vs. RUB vol spread. The construct appeals because it -

a) is largely neutral to oil price developments, so offers a slightly different risk profile to existing bullish RUB carry positions in the portfolio and

b) enjoys more than 2 pts of ex-anteimplied - realized vol carry (refer above chart), which mitigates to some extent the negative of less-than-stellar entry level on implieds.

The RV edge can be further magnified by deploying OTM USD calls instead of ATMs: USDCAD risk-reversals are materially more depressed than USDRUB even adjusting for base vols (CAD 3M 25D RR 0.4, RR/ATM ratio 0.06; RUB 3M 25D RR 2.6, RR/ATM ratio 0.26) and discount little trade tension anxieties; the additional smile theta of the RUB leg is worth earning in our view in a rising oil price environment when RUB puts are unlikely to be called into play.

We open a 100:65 vega-weighted (~premium neutral) long CAD vs short RUB 3M 35D USD call switch.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms