The two main events this week though are the FOMC meeting on Wednesday and the BoE meeting Thursday. In regards to the former, the Fed is fully expected to raise rates by 25bps, but the focus will be on the message from the new Fed Chair Powell and whether they start to guide the markets towards four hikes this year.

FOMC decision should help determine the near-term trajectory. Fed will hike more in order to keep inflation low: With inflation rising, the FOMC will be more confident in rising rates further towards, and finally above the neutral level, estimated at 2¾%.

NZDUSD near-term momentum remains negative, threatening a break below the technically key 0.7185, with US strength and risk aversion taking turns as the primary influencer.

Medium-term perspectives: The US dollar is yet to establish an uptrend, which means further gains in NZDUSD are likely during the month ahead after FOMC’s monetary policy. Further out, though, we are bearish. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.69 by mid-year.

OTC Outlook and Options Trade Recommendations:

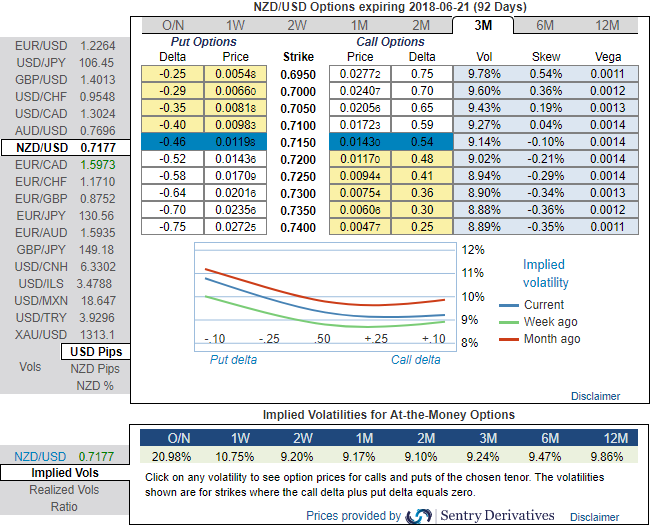

At spot reference: 0.7292, since the 3m skews are targeting towards OTM put strikes at 0.70, whereas 1m skews signal hedging interests both the sides, we’ve recommended put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

Please noted that 1m IVs are just shy above 9.17% and 9.24% for 3m tenors. Hence, the option the holder of OTM put is deemed to be on upper hand. On the contrary, lower IV environment while rising underlying spot sentiments would be conducive for option writers of such overpriced puts.

Hence, the strategy reads this way - writing 1m (1%) in the money put with positive theta snapping decisive rallies, you could easily make out short legs on OTM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 3m 1% ITM puts, the structure could be constructed either at net debit.

Theta shorts are recommended in this strategy because Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -114 levels (highly bearish), while hourly USD spot index was at shy above 48 (bullish) while articulating at 05:58 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady