Macro outlook:

The near-term outlook for sterling is murky given that there are several factors likely to pull the currency in offsetting directions. The positives include:

i) The possibility of a more conciliatory approach from the UK towards Brexit negotiations with a more realistic appreciation of the timelines involved given the reliance of the Conservatives on DUP support and a smaller majority.

ii) Reduced UK break-up risk is given a slump in SNP support, and

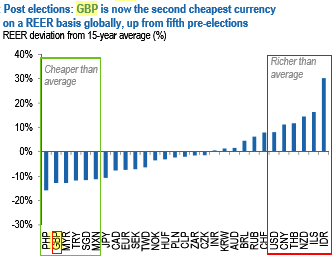

iii) Cheap GBP valuations on some longer-term metrics. The additional 1.5% weakening in GBP in response to the election has made GBP the second cheapest currency globally on an REER basis (refer above chart).

We see in the UK, new politics with further signs that the UK and the EU are entering the Brexit negotiations some distance apart.

Growth slows below 1% as consumers are squeezed by inflation and falling house prices. 2) Outright capital repatriation from slower moving long-term investors including central banks. 3) Initial Brexit talks flounder on the size of the UK's exit-bill.

On the flip side, Australia got a softer start to Q1 GDP accounting, Australia’s nominal trade balance increased by A$8.9 billion in Q1.

China eases policy and commodities rebound;

The Australian housing market reaccelerates.

RBA left the cash rate unchanged at 1.5% in May.

Well, all these macros standpoints could propel GBPAUD either side but more downswings potential.

Consequently, in the prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7650 levels, currently trading in non-directly to signal some bearish pressures. We advocate below hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 2w (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: The Vega of a short (sell) option position is negative and an increasing IV is bad. Please be noted that the 1w IVs are just shy above 8%, whereas ATM calls are overpriced 27% more than NPV, hence, we foresee writing such exorbitant calls are beneficial as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms