Amid the seventh round of NAFTA negotiations (scheduled on 25th Feb-5th Mar), in this write up, CAD forecasts are upgraded removing a NAFTA-scare discount in 1Q and forecasting more strength by end-18 on higher oil prices and a wider dollar discount, BoC policy rates are likely to add on bullish sentiments in addition.

Despite being ultimately net unchanged versus the dollar in the past month since crude rallies to previous highs of $64.75, CAD has broadly underperformed non-dollar peers. Loonie seems to be weaker versus most G10 peers (mostly neutral against USD and AUD), and three-quarters of the EM universe and is roughly 1% lower versus its trade-weighted basket.

But for now, the lingering NAFTA concerns likely illuminate the widening short-term fair value discount versus non-dollar peers. Although the dollar discount has widened broadly further year-to-date, including versus CAD, CAD itself has become materially discounted, on average by 3%, against non-USD G10 currencies. We think this is most likely due to the overhanging NAFTA uncertainty driving an inherent discount, and discouraging CAD positioning as a vehicle for short USD expressions.

But near-term NAFTA break-up risks have diminished materially. This is despite comments from Canadian PM Trudeau that “Canada is willing to walk away from NAFTA if the United States proposes a bad deal”, a headline that exacerbated equity market driven CAD weakness two weeks ago.

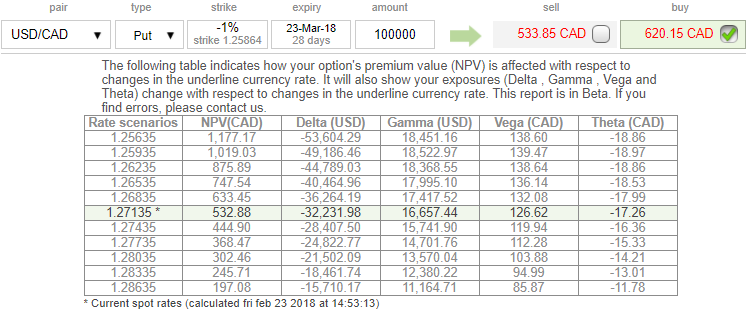

Despite the prevailing bullish sentiments, we at EconoTimes advocate to choose write options instruments, otherwise, even if the analysis is accurate, you may not fetch the desired results. Please note that the 1% OTM put option of 1m tenor seems to be overpriced 16.5% more than NPV, whereas, the ATM IVs of this tenor is well below 8%. This disparity should not ruin our trade objective even though our trend prediction turns out to be true. While risk reversals are still flashing bullish neutral risks.

Hence, these overpriced put options are unwise to blow out of the proportion.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying above 189 levels (extremely bullish), while hourly USD spot index was at -51 (bearish) while articulating (at 09:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis