Bank of Japan (BoJ) is lined up for its monetary policy on Thursday, to maintain negative rates on hold. We ruled out slow normalization of monetary policy, as inflation in Japan has so far made no attempt to approach the BoJ's 2% inflation target.

The BoJ is no longer expected to raise the yield target in 2020 given the downgraded inflation outlook.

USDJPY hedging updates: USDJPY dipped from 112.137 to the recent lows of 110.746 levels, but the defensive yen has lost somewhat from last two days. Most importantly, the positively skewed IVs of 2m tenors are still signifying the hedging interests for the bearish risks. The bids for OTM put of these tenors signal that the underlying spot FX likely to break below 109 levels so that OTM instruments would expire in-the-money.

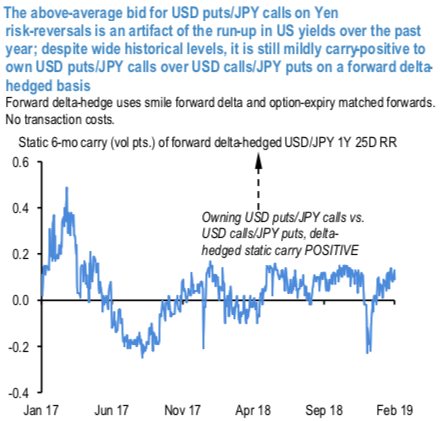

Amid low vol scenarios among G7 FX space, the other feature of the USDJPY vol surface that has received more than its fair share of attention this year is risk-reversals. 1Y 25D riskies @ 1.7 vol bid for USD puts/JPY calls over USD calls/JPY puts are wide by historical standards and nominally as stretched as at the height of the EMU’11 and EM ‘15/’16 market crashes. This is not as anomalous as it appears at first glance, however, since the recent skew widening can be entirely justified by the surge higher in US rates, and hence US – Japan rate differentials, through the past 3 years of Fed hikes.

USDJPY risk-reversals ought to bear some link to the level of the rate differential / forward points, because the absence of such a relationship in extremis, consider zero risk-reversals when policy rate differentials are north of 300bp – would allow market participants to construct delta-hedged risk-reversal packages (long USD puts/JPY calls + short USD calls/JPY puts + long USDJPY forwards as the delta-hedge) that are convexly geared to a market crash, while also earning abnormally large ex-ante static carry via the forward delta hedge.

Convex crash hedges ought to cost, not earn, carry to hold, hence such unusually attractive risk-reversal vs. forward point set-ups tend to attract enough investor interest to buy riskies that raises their cost to levels more commensurate with forward points. The flow culprit behind Yen riskies having climbed to the levels that they have currently is likely Japanese exporter and/or institutional hedging demand for USD receivables/assets. They would have very likely done the carry math and arrived at the conclusion that risk-reversals were the more carry-efficient vehicle to sell dollars.

Indeed, the 1stchart plots the 6-month static carry of forward delta-hedged USDJPY risk-reversals and illustrates that despite wide levels historically, it is still mildly carry-positive to own USD puts/JPY calls over USD calls/JPY puts delta-hedged, implying that it is still beneficial for hedgers with dollar-selling needs to do so via risk-reversals than via forwards. This calculus will change if Treasury yields fall from here or if riskies revisit their flash crash wides, but for now, there is little reason to think that Yen skews are wildly inappropriate on rates alone. Courtesy: JPM & Saxo

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 5 (which is absolutely neutral), while hourly JPY spot index was at 116 (bullish) while articulating (at 12:55 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data