The valuation of financial derivative securities crucially depends on the market participants’ expectation of future volatility which is also known as implied volatility, and FX options are no exceptions. Hence, the essence of implied volatility arises as it often garners as much attention as the option price in option listings, and estimation of future volatility is a critical aspect of market research.

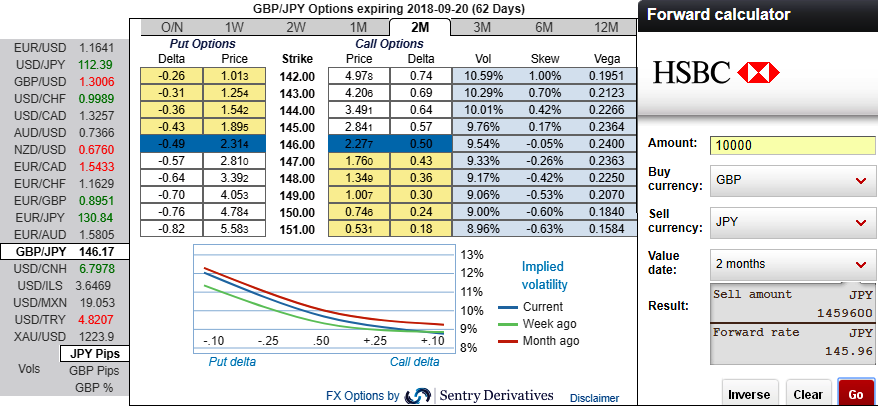

Before we proceed further, please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 142 levels (refer above nutshell evidencing IV skews). As you could observe GBPJPY forward rates across different tenors (refer above nutshell), these derivatives instruments indicate bearish targets of this pair.

Because the option pricing depends on future volatility, and it is quite impossible for anyone to ascertain accurate future volatility. Nevertheless, it is quite possible to calculate the marketplace’s expected future volatility using the option’s price itself which is known as implied volatility (IV). Options with a higher IV cost more. Well, this is quite intuitive owing to the higher likelihood of the underlying GBPJPY market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good.

Most importantly, GBPJPY bears have resumed their business in the underlying spot FX prices. The pair has tumbled from the highs of 149.311 levels to the current 145.980 levels in just last 4-5 days. Thereby, prices have gone below 21-DMAs with strong downside momentum.

In this bearish scenario, put ratio back spreads have been advocated couple of days ago (to be precise on 27th June), wherein short leg has functioned since then as the underlying spot FX kept spiking exactly from 28th (refer above technical chart), we would like to uphold the longs in the same strategy on hedging grounds for now.

Both the speculators and hedgers who are interested in bearish risks are advised bidding 2m skews to optimally utilize Vega longs.

The execution: 2w (1%) OTM put option (position seems to be expired worthless as the underlying spot went upside), uphold longs in 2 lots of vega long in 2m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

The fresh Vega longs are encouraged for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -122 levels (which is bearish), while hourly JPY spot index was at 48 (bullish) while articulating (at 10:05 GMT). For more details on the index, please refer below weblink:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?