The RBNZ is scheduled for their monetary policy this week, the market pricing for RBNZ implies a 60% chance of easing on 13 November, with a terminal rate of 0.70%.

The kiwis central bank cut 50 bps in its August meeting and had said that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point.

They have demonstrated its willingness to take bold steps, which means markets are likely to remain dovishly positioned for some time. As discussed in our recent posts, we now think the odds favor the further RBNZ rate cut the OCR to a new low of 0.75% in November. Combined with easing from other central banks, that should push NZ swap rates to fresh record lows.

Hence, we reckon that any abrupt rallies of NZD would be momentary, NZDUSD is expected to depreciate towards 0.60 levels by year-end.

NZDUSD potential to break above 0.6370 levels in the near terms. Today’s inflation expectations survey poses event risk.

The medium term perspectives: The RBNZ decision this week would be influential near term, but beyond that, the US dollar would be key. Earlier this month saw the USD firm with rising yield spreads, but over the next few months we expect global trade tensions to be the main driver of USD strength.

OTC Updates and Hedging Strategies:

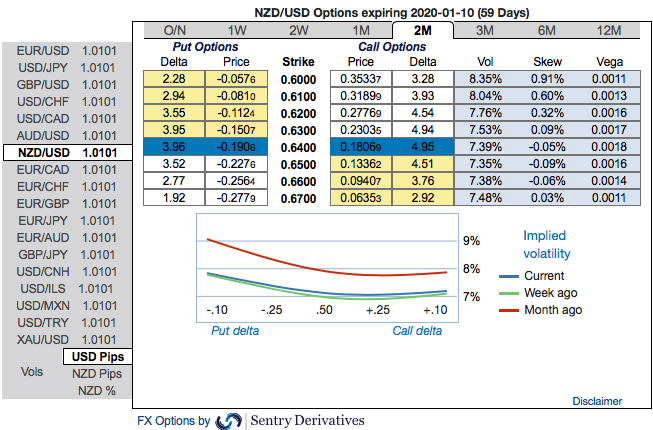

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 7-8%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Most importantly, positively skewed 3m IVs advocate both upside and downside risks.

Contemplating above fundamental factors and OTC outlook, diagonal debit put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

Alternatively, we advocated initiating longs in NZDUSD futures contracts of November’19 delivery as further upside risks are foreseen and simultaneously, shorts in futures of December’19 delivery are the most important for the major downtrend.

Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentry & Westpac

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed