We reckon that the European economy was too fragile for the euro to be able to capitalize on the abrupt change in tone from the Fed or the threat to the credibility of US policymaking.

This stance hasn’t necessarily altered in the intervening period, even though the Fed has now gone even further in signaling not only a shift in stance but also potentially a change to its reaction function, one that is more permissive of an inflation overshoot. Crucially for EURUSD, the European data flow remains distinctly poor, Italy, for instance, is languishing in a self-inflicted recession, and the ECB is now acknowledging the persistence of these downside forces in a way that suggests it could temper its forward guidance on rates, potentially as soon as the March ECB meeting when the staff forecasts are next updated.

Whereas it was understandable that EURUSD popped higher on the Fed, it is also understandable that the euro has been unable to sustain, let alone build on, those advances.

EURUSD OTC outlook:

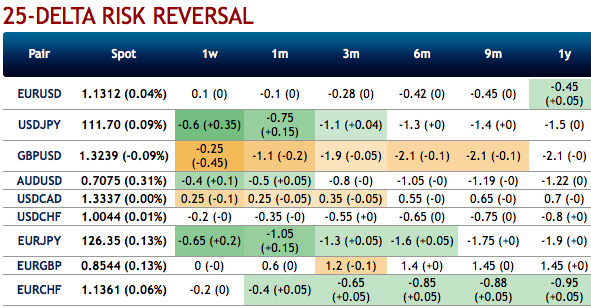

Please be noted that EURUSD shows convergence between implied volatility (IV) and historic volatility (HV) curves, the trend of lower vols is still imminent. Also, be noted that spot and risk reversal curves. Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above chart, Jan’2018 seems to be an average month as the divergence between implied volatility and historic volatility. IVs have constantly been sliding, while RVs are also following.

While spot curves move in tandem with the risk reversal curve until of-late, now they are also showing convergence.

We could foresee potential for further USD strength and limited risk of significant USD weakening this year, and notably, our EURUSD forecast is now running close to forwards on all horizons (vs previously above) and across tenors.

As a result, we recommend hedging USD-denominated income via risk reversals: this allows one to profit from some dollar strength near term (as per our call), yet still secures a worst-case rate without locking in the negative carry from the outset.

From this perspective, the real far-off month, when HV is actually lower than implied volatility, then the only such instance of convergence during the recent timeframe observed. While 3m positively skewed IVs have stretched on either side to signal both upside and downside risks. Skews stretched towards both OTM calls and OTM put strikes signifies hedgers interest on either side.

Overall, the topic is particularly relevant at a time when EURUSD forward points are at a historic all-time high and IVs are dipping, that increases the interest of looking for derivatives-based strategies for hedging long USD cash positions. Courtesy: JPM & Danske

Currency Strength Index: FxWirePro's hourly EUR is flashing at 70 (bullish), hourly USD spot index is sliding towards -96 levels (which is bearish), while articulating (at 07:18 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics