We expect MXN to weaken in 2Q as election risks increase, but to resume strength afterwards as the environment favors carry. We recommend hedging MXN exposures in the short-term and recently moved to UW in the GBI-EM Model Portfolio.

First, fundamentals have improved but are unlikely to matter for market participants ahead of the elections.

There have been two important risks remain key for market participants. First is NAFTA. Our base case is that NAFTA renegotiations will be successful, but we have argued that the details will be crucial to determine how Mexico’s balance of payment could evolve.

Second are the elections. Most recent polls have shown that AMLO’s popularity was mostly unshaken by the debates, and he continues to lead by a wide margin (see Exhibit 1). Even though we - like most market participants -expect largely an AMLO victory, some investors were still pricing in a small probability of the runner-up gaining some ground.

Bearish scenarios: USDMXN at 21 on a disordered NAFTA negotiation, political noise regarding elections and escalation of bilateral relations between Mexico and the US.

Bullish scenarios: USDMXN at 17.5 in 2Q’18 on orderly NAFTA negotiations and a reduction of political noise locally and externally.

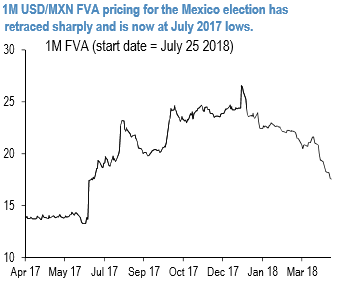

The analyzed profitability of trading FVAs around elections and found that the ratio of 1M FVAs (start date set at around 1 week before event risk) to ATM vols is a good metrics for estimating profitability. Namely, if the ratio is > 1.5 FVA is a sell and vice-versa FVA is a buy when the ratio is below 1.5.

At the current market, USDMXN 1M FVAs mid with the start date set to June 25 are priced more than 8 vols below the January cycle high and come at a modest 1.3X ATM vols (refer above chart) implying a good value in owning election vol to hedge the residual election risk. With overnight pricing commanding a punchy bid/offer, the equivalent pre-/post-calendar spreads (selling pre-event options and buying post-event options in order to isolate and capture sharp spot moves/realized volatility) are worth considering.

We recommend buying 12-week USDMXN ATMF straddles @14.75/15.25 financed by selling 8 week straddles @12.95 choice. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts