USDTRY slide which begun in 2014 when Turkey witnessed protests and corruption scandals followed by two elections in 2015 is being driven by most sectors ranging from services and retail trade to construction. After surprisingly rising in July despite a military coup attempt, confidence fell back sharply in August, in line with the reality of emergency rule in Turkey.

Today, we get the trade and foreign tourist arrivals for July: both readings are expected to be on the weak side, with the trade deficit probably recording USD 5 bn, and tourist arrivals likely down by another 40% YoY.

Going forward, tourism data are likely to remain weak, while we could see some recovery of exports as preliminary indications from August suggest; the current-account deficit is likely to stabilise in the medium-term at c.4% of GDP.

Weaker real economy data will only intensify political pressure on CBT to cut rates quicker: we foresee USDTRY at 3.25 by year-end.

Hedging Strategy of USD/TRY : Diagonal Spread

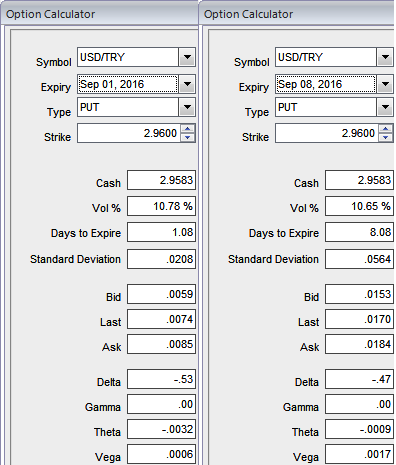

In OTC FX market, the current ATM IVs of USDTRY is at 10.78% and 10.65% for 1w tenor.

Hence, go long in 1M ATM -0.49 delta put option while shorting 1W (1.5%) Out of the money put with positive theta or closer to zero for time decay advantage on shorter tenors on the short side.

Here, in this case, ATM puts are more expensive than OTM options but cheaper than ITM options.

Because these instruments have the highest Gamma, Vega, and Theta which would mean their premiums are the most sensitive to moves in underlying spot FX.

They are particularly sensitive to Theta as the time to expiry approaches.

As USDTRY drifts below spot ref: 2.9587 but remain at or above OTM shorts within 1 weeks time, then the initial premiums received on shorts can be the certain yields.

Thereafter, the strategy constructed above is likely to fetch positive cash flow as the underlying spot FX keeps dipping, but use tenors as accurately as stated above.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says