US-Canada trade relations have entered a rockier patch under the Trump administration with tariffs placed on Canada’s softwood lumber industry and threats of further action against other industries. More recently, the US activated the procedures for renegotiating NAFTA. Beyond trade, growing uncertainties about US economic policy have also affected sentiment in Canada negatively.

DM bond yields have been the primary driver of G10 currencies since our last publication a month ago. The largest moves have come from CAD (stronger) where the BoC turned hawkish.

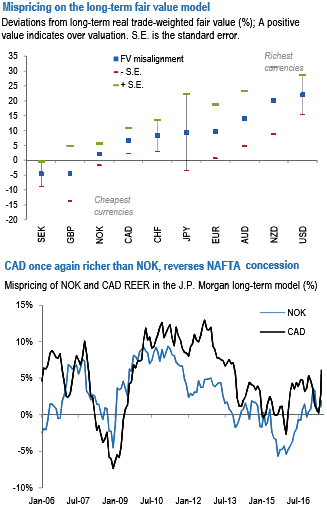

The NAFTA renegotiation concession CAD had built in has been completely reversed with a more hawkish BoC stance.

The richness for CAD on the framework had declined from 5% vs. fair value to 0% following the surprise US election outcome (refer above chart), but this has reversed completely in the past two months. With this adjustment, CAD is now once again richer than NOK on a REER basis in the model.

Nonetheless, the richness is relatively modest by historical standards and relative to other currencies with CAD squarely in the middle of the pack (refer above chart).

CAD upgraded near-term on hawkish BoC but forecasts are still bearish medium-term. USDCAD year-end target declines 5% to 1.30; 2Q18 unchanged at 1.34 from a month ago forecasts.

Luring Lonnie’s optionality - USDCAD unlikely to hit 1.23 knocks out from above 1.32:

Buy USDCAD 2m put strike 1.27, knock-out 1.23 Indicative offer: 0.40% (vs 0.48% for the vanilla, spot ref: 1.2992)

Unlike a vanilla call or put, the RKO maximum potential leverage can be monetized only in holding them until the 2m expiry. These short gamma options are long theta, so that the time value slowly converges towards the intrinsic value only in the end.

Risk profiling: Massive downside Investors buying a knock-out option cannot lose more than the premium initially invested. However, if the USDCAD hits the 1.23 barrier at any time before the 2m expiry, the option will instantly expire.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings