The pound has been especially sensitive to Brexit developments over the last few months. In December, the EU determined that ‘sufficient progress’ had been made on divorce-related matters - which included coming to a financial settlement in the region of £35-40bn, no hard border between Northern Ireland and the Republic of Ireland and agreeing on the rights of EU citizens – allowing discussions to move onto the nature of the future trading relationship.

Initial statements from Brexit Secretary Davis and EU Chief Negotiator Barnier have highlighted how negotiations could yet test the unity of both sides. Davis has suggested that the UK is aiming for a ‘Canada plus plus’ deal, adding that the intention through negotiations is to treat goods and services as ‘inseparable’.

However, Barnier has already outlined that there will be no ‘special’ treatment for the UK financial services sector.

Even with sterling making new lows in trade-weighted terms (nominal and real), we see only the GBPUSD meandering in a 1.30 - 1.35 range for most of 2018.

A fall to GBPUSD 1.20 would require, above all else, a stronger US dollar rather than a weaker pound alone.

We think the chances of a fall that far are about 5%, whereas, by contrast, the chances of the GBPUSD reaching 1.50 are around 15%, reflecting the possibility of another election being called and speculation emerging in earnest, that the UK could see a second Brexit referendum.

That is unlikely but not impossible and not definitely priced in by the FX market.

OTC outlook and options strategy:

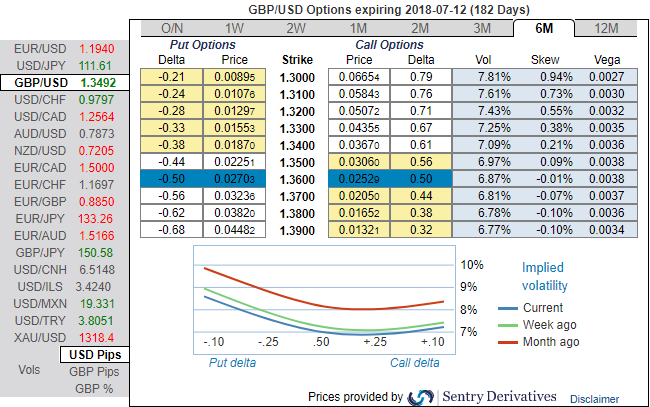

Let’s glance on sensitivity tool, the positive shift in risks reversals that indicates the bullish risks in underlying spot FX prices.

Positively skewed IVs coupled with bearish neutral risk reversals of 6m tenors signifies the interests of OTM put strikes that means the ATM puts have the higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in 1m tenors that are favorable to both call and put options holders’ advantages.

Bearish neutral risk reversals indicate hedgers still bid for downside risks.

Hence, in order to arrest both upside risk that is lingering in intermediate trend and major declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in short run and mitigates bearish risks in the medium term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 6m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields