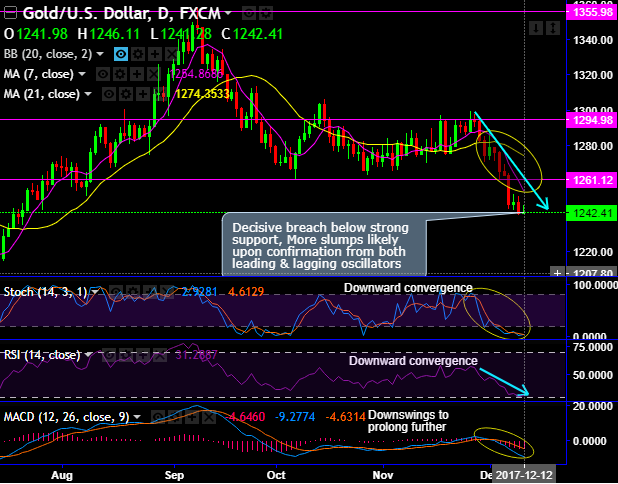

Chart and candlestick pattern formed: 50% Fibonacci retracements from the peaks of $1357.47 (refer weekly plotting).

The decisive breach below strong support at $1261.12, that’s where a stern bearish candle pops up with a big real body (refer daily chart).

Momentum study: Both RSI and stochastic curves converge downwards to signal the intensified bearish momentum.

Trend study: On time frames, both lagging indicators (bearish DMA, EMA & MACD crossovers) indicate the downtrend continuation in the days to come.

Well, for now, more slumps seem to be likely upon confirmation from both leading & lagging oscillators.

Meanwhile, Fed is scheduled to announce funds rates decision tomorrow, and we’ve already stated in our previous post that the Federal Reserve is no longer expected to pause the rate hike cycle early next year for two main reasons. Primarily, the nomination of Governor Powell as the next Fed chair, in our view, represents a vote for continuity of policy. Secondarily, the unemployment rate is falling again. At 4.1 percent, the risk of a substantial undershoot is rising, Barclays Research reported.

Accordingly, we advocate short hedges in yellow metal on waning safe-haven sentiments as Fed hiking season looms.

Gold prices have tumbled from the highs of peaks of 1299.10 to the recent lows 1240.70 levels or 4.49% in just three weeks.

As the further bearish risks are foreseen, hedge via shorting CME Gold futures of Jan’17 delivery as the yellow metal hit its least since 24th July at $1,243.56 on Tuesday on waning sentiments of demand for safe-haven assets.

We have already labeled our bias to enter short trade recommendations in gold and silver but decided to hold off given the looming monetary policy seasons (metals weekly gold and silver bulls received some sort of gift-wrapped headlines last week but higher US rates would eventually spoil the party).

For today, gold prices edged higher in European trading session but held near their lowest level in around fifth month amid growing expectations for two more hikes in the U.S. interest rate next year. The metal is highly sensitive to rising U.S. interest rates.

The price forecasts of gold for next 1m is at $1,225/oz. This is bearish, as the 6m forward curve is at $1,295/oz. If the most extreme upside price risk prevails, we could see prices maximum $1,325/oz. If our most extreme downside risk prevails, we could see prices average $1,175/oz.

Our 12m forecast for gold is $1,175/oz. This is a very bearish outlook, as the 12m forward curve is at $1,312/oz. We expect prices to fluctuate between $1,175/oz and $1,350/oz over the next 6–12 months.

FxWirePro: AUD/USD eases slightly but trend is still bullish

FxWirePro: AUD/USD eases slightly but trend is still bullish  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish

FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish  FxWirePro: GBP/NZD outlook weaker on renewed downside pressure

FxWirePro: GBP/NZD outlook weaker on renewed downside pressure  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  NZDJPY Bulls Eye 95: Why Buying the Dip is the Strategic Play

NZDJPY Bulls Eye 95: Why Buying the Dip is the Strategic Play  FxWirePro: USD/CAD extends gains, eyes 1.3800 level

FxWirePro: USD/CAD extends gains, eyes 1.3800 level  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close