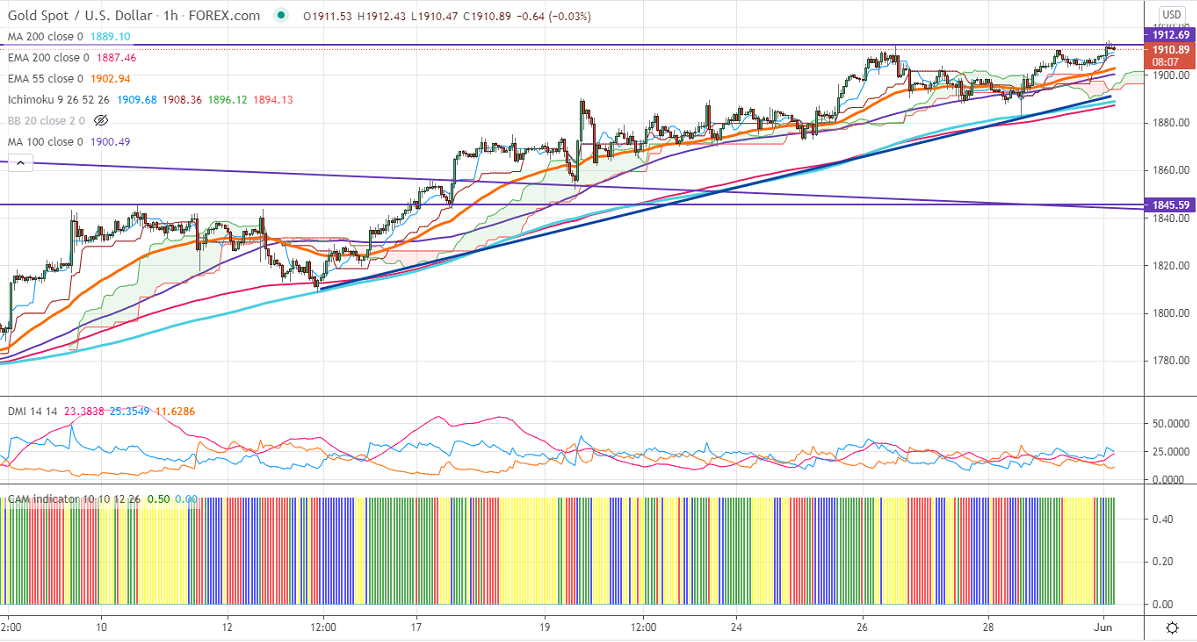

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1909

Kijun-Sen- $198.36

Gold has once jumped above $1900 on board-based US dollar weakness. The US dollar index is holding below 90 levels, any breach below 89.20 confirms a bearish continuation. The US 10-year bond yield is consolidating after a minor decline despite strong inflation data. Markets eye US ISM manufacturing PMI and construction spending data for further direction. Gold hits an intraday high of $1914 and is currently trading around $1911.

Technical:

It is facing strong support at $1880, violation below targets $1870/$1860/$1840/$1820. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1920, any convincing break above confirms bullish continuation. A jump to $1932/$1950 is possible.

It is good to buy on dips around $1872-73 with SL around $1860 for the TP of $1900/$1920.