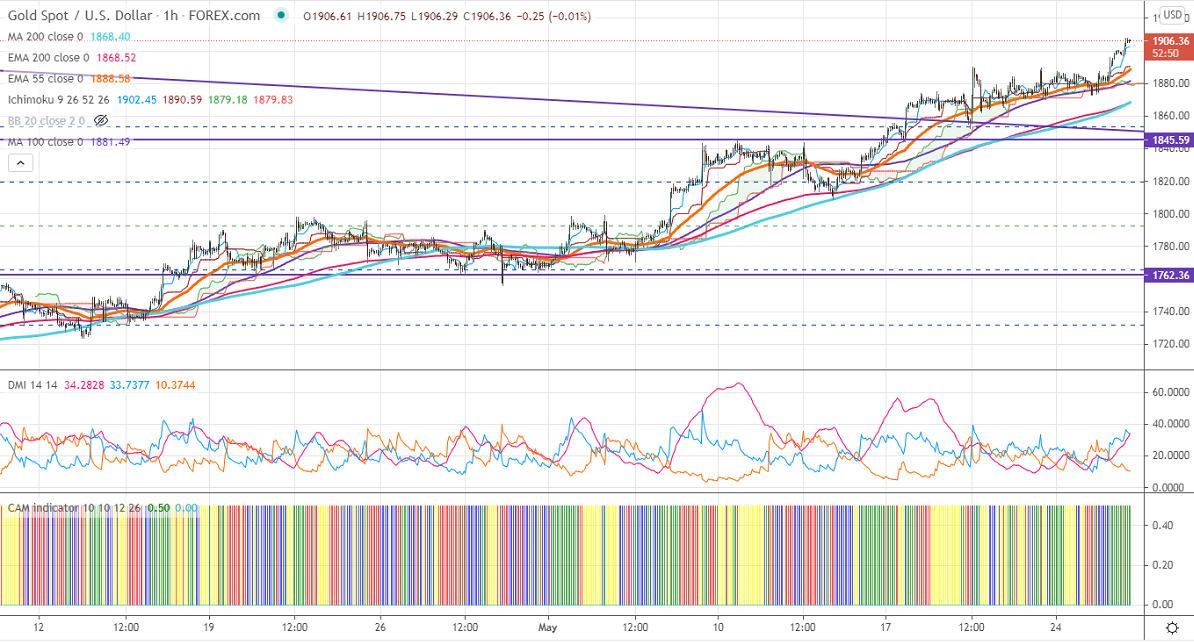

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1902

Kijun-Sen- $1890

Gold has shown a massive buying and hits a 4-1/2 month high on board-based US dollar selling. The slight decline in US bond yields as Fed will not taper its bond-buying program. The US10-year bond yield lost more than 8% from minor top 1.692%. DXY is still holding below 90 levels and any violation below 89.20 confirms further bearishness. The conference board consumer confidence eased to 117.2 in May compared to a forecast of 118.80. The yellow metal hits an intraday high of $1907.84 and is currently trading around $1906.28.

Technical:

It is facing strong support at $1890, violation below targets $1872/$1860/$1850. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1920, any convincing break above confirms bullish continuation. A jump to $1932/$1959 is possible.

It is good to buy on dips around $1878-80 with SL around $1860 for the TP of $1932.