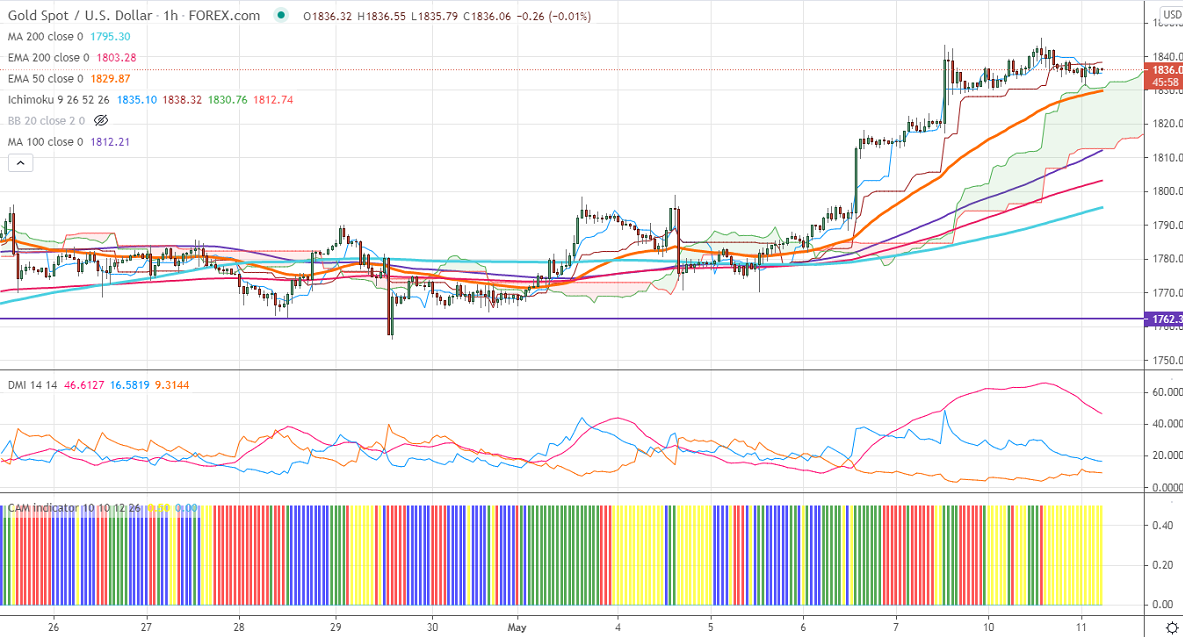

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1835

Kijun-Sen- $1838

Gold is consolidating after hitting a three-month high of $1845 on broad-based US dollar selling. DXY continues to trade weak for the past five weeks and holding below trend line support of 90.40. The increase of new coronavirus cases in major countries like India and Akshaya Tritiya will increase demand for Safe-haven assets like gold. The minor pullback in US bond yields is putting pressure on yellow metal at higher levels. The US 10-year bond yield surged more than 8% from minor bottom 1.48%. The yellow metal hits a high of $1843 and is currently trading around $1834.

Technical:

It is facing strong support at $1829, violation below targets $1823/$1811/$1790/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1850, any indicative break above that level will take till $1870/$1900.

It is good to buy on dips around $1815-16 with SL around $1800 for the TP of $1870.