1992 saw EURGBP, inferred from GBP/DEM, rise from around 0.70 to 0.86 in 1993. GBPUSD fell from 2.01 to a low at 1.41. The pound’s fall since early 2015 has seen EURGBP rise from 0.6936 to the August highs of 0.93, in the broadest possible terms. On the other hand, GBPUSD has tumbled from a peak above 1.70 in 2014 to a low below 1.19.

That leaves sterling nearly 10% undervalued against the dollar on a PPP basis, but not very undervalued against the euro. Low levels of gilt yields remain an anchor on sterling. EURGBP’s recent correction looks very warranted and the GBPUSD bounce looks very sensible. But thinking about yields also highlights the key to the sterling outlook.

It’s important to recognize that a less assertive BoE outlook is not the only factor weighing on GBP. In particular, the GBP TWI has now given back 80% of the gains it made following the hawkish September MPC whereas the rate market has retraced by less than a third (based on the Dec 19 short-sterling contract).

OTC outlook and options strategy:

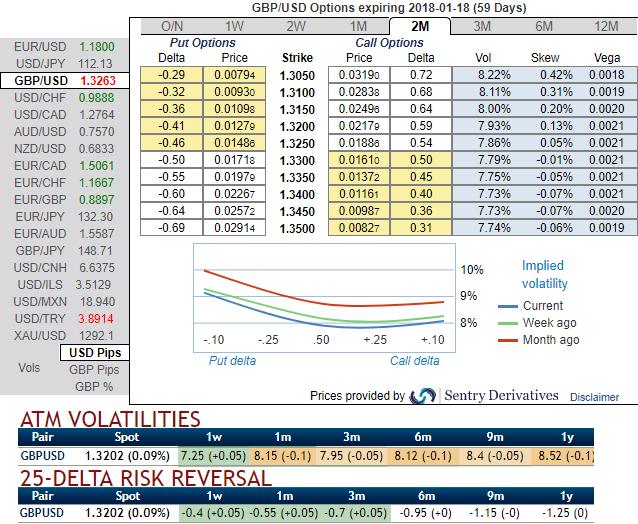

Let’s glance at sensitivity tool, the positive shift in risks reversals that indicate the bullish risks in underlying spot FX prices.

Positively skewed IVs of 2m tenors signifies the interests of OTM call strikes that means the ATM calls higher likelihood of expiring in-the-money while shrinking implied volatilities in longer tenors are unfavorable to options holders’ advantages. Negative risk reversals indicate hedgers still bid for downside risks. ATM IVs are still stuck between 7.9 to 8.15% range for 1-3M tenors.

Hence, in order to arrest this upside risk that is lingering in intermediate trend and major declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in short run and mitigates bearish risks in the medium term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2m expiries, these options positions construct smart hedging at net debit.

As shown in the above diagram, if you look at the above nutshell that portrays payoff structure, one would be convinced that the strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025