Bearish scenarios:

1) Growth stay nears 1.5%.

2) CPI peaks and wage growth fails to accelerate to 3%;

3) The balance of payments pressure (capital repatriation from LT investors; current a/c stuck at 4-5%). 4) PM May faces a Conservative leadership challenge.

Bullish scenarios:

1) The economy rebounds to 2% on stronger export demand and the curve prices 2 hikes by end-18. 2) The EU softens its stance towards an FTA that incorporates services.

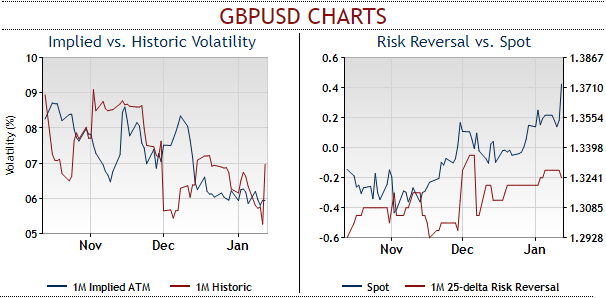

GBPUSD risk reversals (RR) versus spot, valuations and options strategy:

Well, before we deep dive into the comparison between risk reversals and spot FX moves of GBPUSD, let’s shed some light on what exactly risk reversal divulges, RR is an over-the-counter (OTC) structured forward that is primarily used as a hedging solution. The RR proposes the probability to benefit to a limited extent from an appreciation of the foreign currency you are exposed to.

Thereby, you as FX traders are hedged at a predefined exchange rate which is slightly worse (if unleveraged) compared to the Outright Forward rate. You can enhance the hedge rate with the use of leverage however, your foreign currency exposure is then only partially hedged

(Leveraged Risk Reversal). In this case of GBPUSD, you can define the degree of risk/leverage in advance.

From above chart, GBPUSD risk reversals and spot curve divulges the divergence between those two and illustrates the relative price difference between puts (downside expectation) and calls (upside expectation). This chart illustrates the historic relationship between one month 25-delta risk reversals versus the underlying spot rate. Positive shifts signal calls valued higher than puts, negative values indicate puts valued higher than calls.

GBPUSD – 1.50 more likely than 1.20. Even with sterling making new lows in trade-weighted terms (nominal and real), we see only the cable meandering in a 1.30-1.35 range for most of 2018. A fall to 1.20 would require, above all else, a stronger US dollar rather than a weaker pound alone. We think the chances of a fall that far are about 5%.

Whereas, by contrast, the chances of this pair reaching 1.50 are around 15%, reflecting the possibility of another election being called and speculation emerging in earnest, that the UK could see a second Brexit referendum. That is unlikely but not impossible and not definitely priced in by the FX market.

Hence, in order to arrest both upside risk that is lingering in intermediate trend and major declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in short run and mitigates bearish risks in the medium term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 2M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 6m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch