The market participants are quite certain that the Bank of England (BoE) will lower its key rate by 25bp today. That is not a new realisation. The market held the same view a week ago. We have nonetheless seen a slight recovery of Sterling since then.

With spiking implied volatilities in 1w expiries, the gamma adds to the risk and reward profile for both holders and writers.

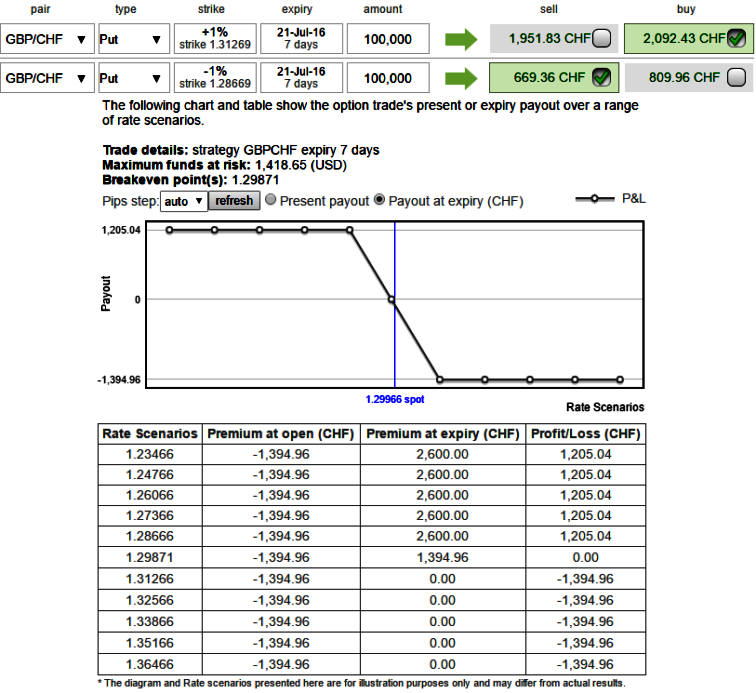

Thus, on a hedging perspective in the long term, using gamma factor in order to neutralize volatility factor, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Gamma is always a positive value, therefore you add Gamma to the value of the current Delta to estimate the new Delta in a rising market and you subtract Gamma from the current Delta to estimate the new Delta in a falling market.

Hence, selling a deep out-of-the-money put option is recommended to reduce the cost of hedging by financing long position in in-the-money put options with longer tenors.

However, speculators no worry to break your head, one touch 0.47 delta calls will come in your way to add leveraging effects of today’s rallies.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated