Option Trade Strategy: Buy 3m USDRUB call strike 59, Sell call strike 62 knock-in 65 Indicative offer: 1.23% (vs 1.06% for the vanilla call spread, spot ref: 56.50) The position entails buying a USDRUB 3m call strike 59 financed by a call strike 62, with a topside knock-in at 65 only on this short leg.

This structure offers potential extra gains compared to the vanilla call spread capped at 62, as the pay-off captures upside up to 65. In the event of a move beyond this barrier, the maximum gain is the same as for a vanilla call spread. Our appearing call spread costs only 17bp more than a vanilla proposal, but it potentially hedges twice as much RUB downside (about 10% instead of 5%), providing additional exposure at minimal cost.

Risk profile: Limited to the premium paid Below the 59 call strike, the maximum loss is limited to the premium paid.

Take advantage of high skew Negative carry is quite punitive in forwards (-75bp/month), so cost-effective option exposure is a good alternative.

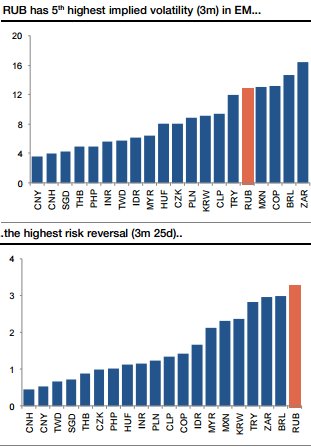

Shorting the RUB in volatility space is also very expensive: implied vol is one of the highest in EM and risk reversals are the highest. The skew-to-ATM volatility ratio has been rising steadily since early 2016, likely related to investors hedging bullish RUB price action. These volatility parameters favour structures that sell topside skew to cheapen up bullish USDRUB exposure.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential