The Brexit negotiations about the transition phase from March 2019 to the end of 2020 are ongoing. The negotiating partners have set a tight deadline until the end of March. That deadline might lapse without result. The foreign exchange market is currently not pricing this risk adequately. To put it another way, it currently offers very low insurance premiums for potential future pound weakness.

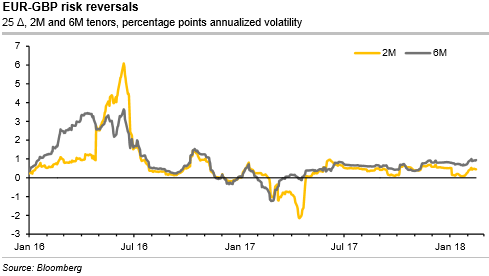

The currency market currently sees only minor risks for significant GBP weakness. It expresses this view in the risk reversals, the difference in insurance premiums against significant ups versus premiums against significant downs of EURGBP. The insurance against significant upward movements of the EURGBP (i. e. significant weakening of the Pound) is hardly higher than that against significant GBP strength (refer 1st chart).

This market view is not in line with our expectations about the further negotiation process. Currently, the details of the transition period (from March 2019 to end-2020) are on the table. What should the relationship between the EU and the UK look like during this period? The negotiating partners have set themselves an ambitious schedule: They want to agree on this part of the Brexit deal by the end of March. However, a situation could easily arise in which at least one side plays for time. After all, an agreement does not really have to be finalized until October in order to make the necessary technical preparations for the transition. This means that both sides will be tempted to hold on to their negotiating positions for as long as possible and let the March deadline pass if necessary. Rumor has it that both sides are preparing for this scenario. We believe it is possible that, in this case, the Pound may experience a temporary episode of weakness. The market does not see it that way.

Hedging against such circumstance seems quite cheaper: 2M risk reversals are trading close to zero, and 2M ATM volatility in EURGBP is still trading at quite a low level (refer 2nd chart). Undeniably, if the expiry of the March deadline would be only the result of negotiating tactics, this does not imply that a timely agreement by October will fail. However, the failure to meet the March deadline certainly does not make an agreement more likely. On the contrary, the “risk” increases with every expired deadline. And this should at least increase the insurance premium for GBP weakness in October.

This means: the low 6-month risk reversals (refer 1st chart) and the low 6-month ATM volatility in EURGBP (refer 2nd chart) could be a quickly disappearing opportunity, which the market might correct once the March deadline has expired. In other words, even for those who only want to protect themselves against an unsuccessful expiry of the (more important) October deadline, the foreign exchange market currently offers what we consider to be an unjustifiably cheap insurance policy. Courtesy: Commerzbank

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data