The Eurozone economy is expected to maintain a moderate rate of economic growth going into 2017, undershooting the European Central Bank’s (ECB) objective. This will likely keep the central bank in a dovish state, although no change in monetary policy is expected through entire 2017, with the deposit rate remaining steady at -0.40 percent and the repo rate at zero percent.

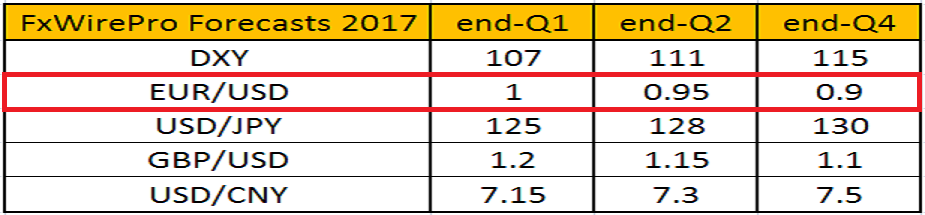

We foresee that the EUR/USD to hit parity by the end of the first quarter and trade at around 0.90 by end 2017, before plunging to its record low of 0.82 towards the first half of 2018.

Moreover, it is worth noting that the heavy sell-off in Euro (EUR) is mainly because of Donald Trump’s fiscal spending appeal, which is expected to be financed from government borrowing and not because of growth in U.S. economy.

If Trump successfully implements his fiscal plan, consumer inflation will surely rise, giving the Federal Reserve wider space for an interest rate hike. Thereby, rising Fed fund rate will increase the cost of borrowing. After the Presidential election result, EUR witnessed a massive selling against U.S. dollar, sending the Euro lower by 9 percent to 1.0398 in just a month’s time.

There seems to exist a number of political flashpoints in the upcoming year; Netherlands is scheduled to hold its general elections in March 2017 where the nationalist/populist-right-wing Freedom party led by Geert Wilders, is leading in the polls. This will be followed by the general elections in France, scheduled for May. Heading to Italy, the populist Five-Star Movement is neck-to-neck with the Democratic Party.

Despite possible uncertainties, we do not expect any major exit to happen in the euro economy; however, risks of such an ambiguous economy into the new year will definitely weigh on the common currency.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?