We favor expressing EURCHF-linked de-correlation ideas in a directional format to assume conditional exposure to EUR strength. If EURUSD rallies about 2% on a benign French election outcome on Monday, it is a fair bet that well correlated Euro-bloc currencies such as CHF will follow a similar script.

Thanks to the SNB’s suppression of EURCHF volatility via active intervention, the beta of USDCHF to EURUSD spot moves has remained near (negative) 1 in the post-franc de-peg era. Even assuming conservative elasticities in the 0.75-0.80 range, this implies USDCHF can fall to 0.9750-0.98 if Euro were to ratchet higher towards 1.10 next week. In turn, the implication for EURCHF is that any bounce in the spot should be relatively shallow, perhaps limited to the low 1.08s (the last chart top at 1.0826 a major technical level.

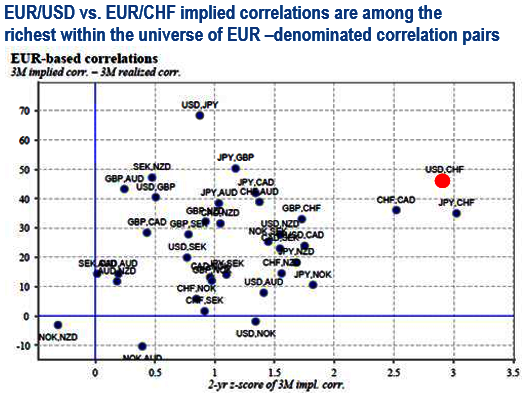

If we are correct, relative volatility levels are well suited to zero-cost expressions of the differing trajectories of USDCHF and EURCHF following a no-drama French vote. The key observation is that within the universe of EUR-pairs, EURUSD vs. EURCHF correlations screen extremely rich, with implied corrs extended to all-time highs at par with the GFC’08 peak and priced an eye- watering 50-60% points above trailing realized corrs (refer above chart).

In normal markets, this would represent an opportunity to fade extremes via [EURUSD higher, EURCHF contained below X] dual digital option structures, but the drying up of the CHF exotic options market after the 2015 franc episode, however, means that the only vanilla options are available.

We propose a reduced form replication of the full EUR-USD-CHF correlation triangle by selling 1M 30D vanilla EUR calls/CHF puts against buying 1M 40D/25D USD put/CHF call spreads for zero-cost, which (a) fits the EUR-recovery view both directionally and in terms of expected spot targets; (b) avoids exposure to a catastrophic left tail outcome in the Euro (both legs expire worthless in such a scenario); and (c) allows premium-constrained investors already exposed to EUR upside to layer on additional leverage at this late stage of the election-trade cycle.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays