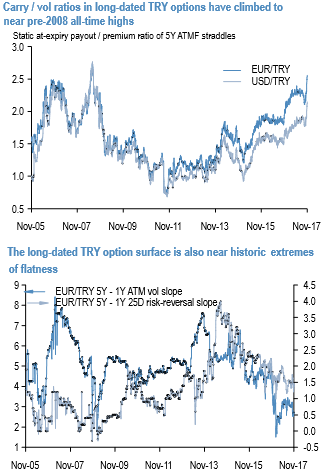

The upshot of this muted vol response is that carry/vol ratios in TRY options have risen to stratospheric levels reminiscent of the pre-Lehman’08 period. At current prices, 1Y ATMF USDTRY straddles are self-financing instruments, with the static interest rate carry on the USD put/TRY call leg of the structure covering 100% of the option premium.

While true for TRY options of all tenors, the set-up is more extreme for longer-dated options which in any case have a general proclivity towards higher carry/vol ratios.

The eye-catching element is the degree to which these ratios have expanded over the past month: for instance, forward points now recoup more than 2X of the (mid) premium of 5Y USDTRY straddles (refer above chart).

EURTRY options are simply turbo-charged versions USDTRY since their near-identical implied vol levels do not adjust for wider forward points in EURTRY on account of negative European yields. Even setting aside high implied yields for a moment, there is a vanilla RV case for preferring to own longer-end TRY options over shorter dated ones predicated on the near-extreme flatness of the option surface across both ATM strikes and risk-reversals (refer above chart), which once again is inconsistent with the prevalence of high interest rates.

The dilemma for investors faced with elevated carry adjusted option prices in EM currencies is whether to play offense or defense –monetize the healthy FX implied yield on offer in limited downside format with options (in this case, purchasing ATMF EUR put/TRY calls or ATMF vs. ATMS EUR put/TRY call spreads), or adopt a more cautious approach of buying ATMF straddles where points carry merely serves to subsidize the cost of owning option protection?

While taking advantage of the same vol surface set-up, the core alpha drivers in the two cases are different: the former seeks to harvest high yields and implicitly relies on the persistence of a positive risk backdrop, while the latter is a defensive posture intended to hedge against an eruption in volatility and hence is currency bearish at heart.

Given Turkey’s well-flagged macro vulnerabilities, still sizeable investor positions, and tail risks of higher oil / quicker inflation / faster-than-expected Fed hikes next year, we lean towards the latter camp in this case and advocate owning long-dated TRY straddles as a decay-friendly risk mitigator for constructive EM portfolios, liquidity permitting of course. Courtesy: JPM

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different