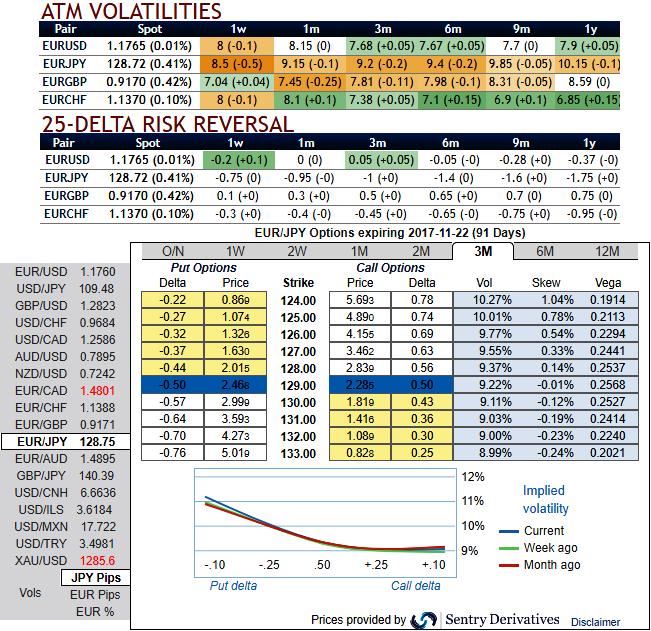

Please be noted that the implied vols of euro crosses have been tepid despite the series data flows are lined up.

Today’s data announcements:

France Markit Mfg, Service and composite Flash PMIs, Denmark Consumer Confidence, Germany Markit Mfg, service and composite Flash PMIs, Eurozone Markit Mfg, service and composite Flash PMIs.

EUR vol risk reversals remain low compared to the level of rates. Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, risk reversals have been bearish neutral. While positively skewed IVs towards OTM put strikes signifies hedgers’ bearish sentiments but puzzles prevailing uptrend of euro.

However, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk. The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

We advocate maintaining the bullish exposure in EURJPY via a call RKO as JPY weakening is likely to be a slow grind rather than explosive.

Sell 6M EUR/JPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Vol pts Positive smile theta participation in Euro bull-trend.

The macro theme of euro area leading outperformance remains dominant; maintain core EUR or proxy longs as growth and inflation data continue to be supportive. Accordingly, encourage long EUR vs in cash (vs USD) and through options in EURJPY (130 call, RKO 135).

Any spot holdings, wise to book returns in long EURJPY cash; but stay long EURJPY in options structure.

A key judgment call in G10 is to separate those central banks that have the potential to change policy in the near term from those that are unlikely to do so. The BoJ is firmly in the latter bucket and its yield targeting framework have left JPY as having the highest beta of any other currency to DM yields.

The short JPY leg of these trades has thus been motivated by its sensitivity to higher yields. We still recommend keeping exposure to long EURJPY trades but think that the move will likely be a grind higher rather than an explosive move that one might expect if the Fed weren’t on the side lines and US yields were moving higher as well. Thus we take profits on the cash version and keep exposure through the EURJPY call RKO to participate in the dubious bull run.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing 58 (which is bullish), while hourly JPY spot index was at -57 (bearish) at 04:45 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation