The BoJ maintains status quo in its monetary policy, it seems that the central bank is focused soothing 10Y Treasury bond yield, the benchmark for long-term borrowing costs, at around zero pct and keep the overnight interest rate around -0.1%. and asset purchases program at ¥80 trillion.

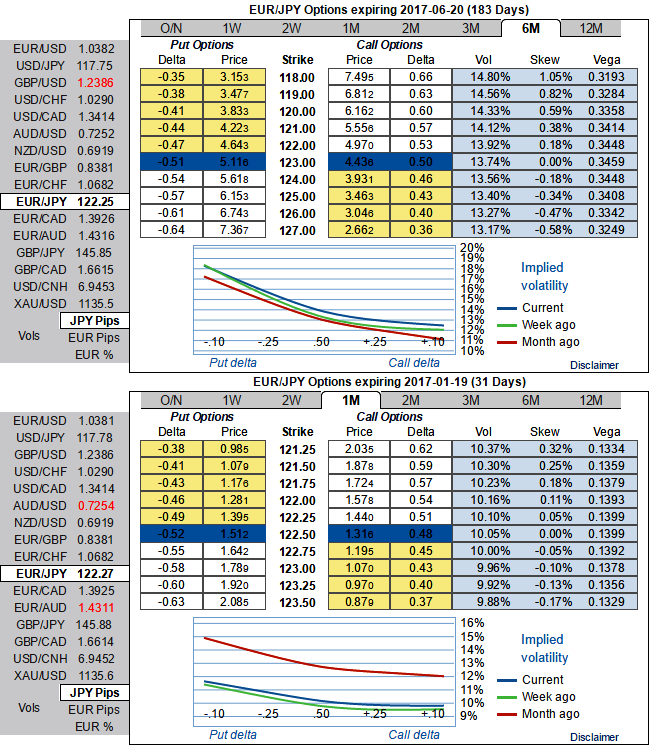

Although you could spot out positive changes in 1m risk reversals and ongoing spikes in the underlying spot, the positively skewed 1m IVs would still keep us alerted on downside risks and same has been the case with 6m skews.

As a result of the short-term bullish swings and major bearish pressures caused firstly by the European central bank with its soft taper as well Bank of Japan’s status quo, we devise below option strategy in order to monitor both puzzling swings.

The diagonal bear put spread strategy is recommended that involves buying long-term puts and simultaneously writing an equal number of near-month puts of a lower strike.

The strategy is constructed at net debit but with a reduced cost by writing (1%) 1m OTM put option, simultaneously, buying (1%) 6m ITM +0.67 delta put options. The Delta represents the option’s equivalent position in the underlying market. A higher (absolute) Delta value is desirable for an option buyer as the holder of an option looks for their option to be more valuable.

We’ve chosen ITM longs because an option moves further in-the-money in 3-months' span, the Delta’s absolute value rises and it becomes more valuable on every corresponding pips (or points) movement in the underlying spot FX.

This strategy is typically employed when the options trader is bearish on EURJPY spot FX over the longer term but is neutral to mildly bullish in the near term that is stated above.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data