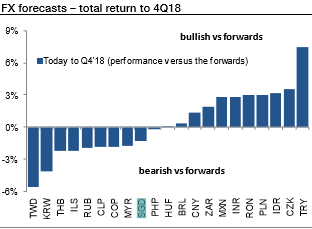

Against the forwards, the forecasts have been the most bearish on the TWD, KRW, THB, RUB & SGD and the most bullish on the TRY, CZK & PLN. On a regional basis, EMEA should outperform. We could foresee slightly more EM Asian FX weakness than consensus, but there have been exceptions.

The GDP in Singapore advanced an annualized 2.8% QoQ basis in the last three months of 2017, below 9.4% in Q3 and market expectations of 2.9%, advance estimates report.

The Singapore economy grew a strong 3.5% in 2017 after a mediocre performance for the past two years of just 2%. This is the best performance since the 3.6% growth in 2014. The domestic sector held up supported by stabilization in the property sector, healthy employment growth, and wage growth.

However, the main factor was manufacturing which benefitted from the upswing in the global economy and the electronics sector in particular. This is expected to continue in 2018 with the government projecting 1.5-3.5% expansion. The strong external environment should also continue to support Asian exports and growth overall.

Singapore trade surplus surges to SGD 4.35 bln in November of 2017 from SGD 4.17 bln a year ago. Total exports increased by 9.6% YoY to SGD 44.91 bln, following a 10.3% rise in October, owing to an increase in both electronic and non-electronic products.

The healthy current account balance positions for a number of countries in Asia, including Singapore, Thailand, and Korea were key factors contributing to their currency gains vs USD in 2017.

For SGD, it gained over 8% vs USD in 2017 vs the average gain for Asian currencies of just below 7%. USDSGD ended 2017 at the lowest level for the year at 1.3360 and it is even lower today. We expect for the 1.3300-1.3500 range near term.

Technically, USDSGD has constantly been sliding below strong supports and forms the double top pattern which is bearish in nature, as a result, bears of this pair achieved new lows of 1.3272 levels. While both leading oscillators are supportive of the bearish momentum and trend extension.

For now, the strong support is seen at 1.3228 level to bounce back which is 60 pips away from the current level.

Hence, we advocate diagonal credit call spread on hedging grounds that addresses both short-term downswings and medium-term upside risks.

This option strategy to keep the potential bullish price risk caused out of fundamental events on the check.

Keeping the both fundamental and technical factors in mind, it is advisable to initiate long in 3M ATM 0.51 delta call while writing 1m (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

The return is limited by ITM shorts, no matter how far the market moves below that point. As shown in the diagram, the profit would be the exponential and unlimited as the underlying spot FX keeps spiking.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts