CBT lowered its overnight lending rate by 25bps yesterday to 8.25% as had been widely anticipated; the central bank kept other policy parameters unchanged. The MPC statement was strikingly dovish in that its first remark acknowledges that growth is noticeably decelerating.

Such dovish remarks indicate that monetary easing will continue. During the course of the coming month, we expect a further 50bps RRR cut as well as the continued easing of macro-prudential lending norms in the retail and credit card markets, as the government has already initiated.

In our view, CBT will wait for the December Fed rate hike to be out of the way before it accelerates direct rate cuts; in the interim, we expect 25bps cuts to the lending rate again in October and in November.

After November, however, scope for direct rate cuts would be finished (the lending rate would be only 25bps above the repo rate); after that point, CBT will have to decide whether to start lowering all rates of the corridor, or ditch the corridor entirely and move to the 'unified rate' that it has been promising. We forecast USDTRY at 3.25 by the end of the year.

Technically, amid robust uptrend and short upswings to begin with 2016, USDTRY has been struggling to continue the long-term robust bull trend, a sharp "shooting star" pattern candle formed at peak of 2.9466 on monthly charts and it has evidenced its bearish effects in the H1 of 2016, current prices are still lingering between 3.0373 and 2.9824 levels.

Hedging Framework:

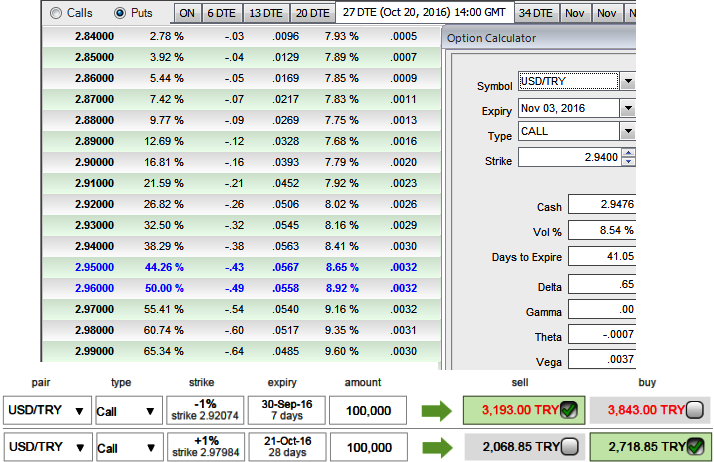

1m ATM IVs of USDTRY is crawling up 8.54%, while the probabilistic numbers show the more likelihood of these options expiring around OTM strikes. ATM calls are priced more than 50%.

Thus, as shown in the diagram, it is advisable to initiate Diagonal Credit Call Spread (DCCS) in order to tackle both short-term dips and major uptrend.

Execution: Keeping the both fundamental and technical factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Well, in above case of diagonal credit call spreads, the strategy could be constructed at the net credit, the short leg would be absolutely at profits when underlying spot remains either at strikes chosen or at higher than strikes on the expiration of short side.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings