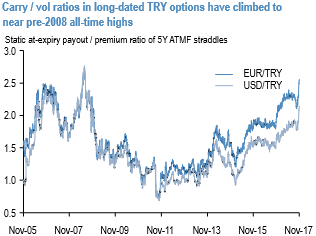

The Turkish lira has been one of the few idiosyncratic FX vol generators this year in a market largely bereft of them. TRY implied volatility and risk reversals are among the highest in emerging markets in the recent past. However, relative to recent history, they are not high in their own right. Current 3m implied vol (12.5) could spike to the 16-20 area if accelerated depreciation did occur, while risk reversals could easily rise by 1-2 vol points. This lends itself to owning volatility, and given the difficulty in ascertaining the probabilities of a “spike followed by a recovery” versus a “trend” move higher in USDTRY, we prefer a one-touch structure over a European digital.

Even after the 12% sell-off in the lira since September, the EMEA analysts note that Turkey's macro and policy challenges abound, most prominently the trend of higher inflation and the threat to current account deficit financing via FII in a moderating EM capital flow and rising oil price environment.

Turkish rates and FX have both responded forcefully to the increase in geopolitical tensions and a sharp rise in US Treasury yields in recent weeks, but FX vol has been a notable laggard in the move.

USDTRY 1Y ATM vol is up 1.5 % pts. over this period which represents an undershoot of the typical spot-vol linkage to the tune of 1% pt., while 1Y 25D risk-reversals are barely changed and were barely profitable if purchased and delta-hedged since early September before the US/Turkey visa spat erupted.

Elsewhere, JPM Commodities research has raised their oil forecasts for 2018based on better-than-anticipated compliance to supply quotas, the likelihood of the OPEC/NOPEC production cut accord being extended through 2018, and a solid rise in global oil demand next year. As a positive current account oil exporter, RUB is the cleanest FX beneficiary of a bullish shift in oil prices and has added tailwinds of high rate carry and cleaner positions/cheaper valuations than earlier in the year that prompted their EMEA team to turn OW last month.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch