After a disappointing GDT auction, attention will shift to the 2Q labor report with consensus looking for +0.7% QoQ employment and 4.8% unemployment (WBC 4.9%). The lack of wage growth is a global phenomenon and so wage levels will be scrutinized too. July house price data is released prior to NZ markets’ open. NZDUSD has been in edging higher at 0.7433 levels with more southward potentials.

OTC Outlook and Options Trade Recommendations:

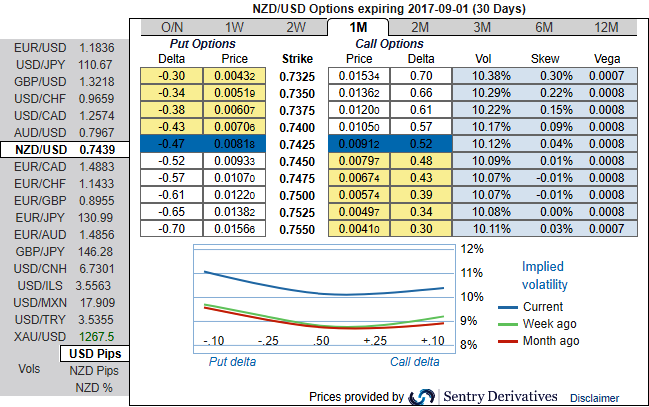

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of 1m tenor signal underlying spot FX is expected to be either edging higher or lower as skews have been well balanced flashing positive numbers on both OTM and ITM strikes and signals bearish risks in 3m tenors.

We’ve constantly been reiterating this strategy contemplating ongoing rallies. On 3rd July (at spot reference: 0.7275-0.73 levels) it was advised to deploy diagonal credit put spreads.

For now, we uphold the same strategy by writing 1m (1%) in the money put while initiating longs in 3m at the money put, the structure could be constructed at the net credit.

By now, you could easily make out short legs on ITM puts of narrowed expiries are going worthless as anticipated.

Upon the mounting bearish risk, sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate the strikes below 0.73 which are our forecasts).

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders amid ongoing bullish swings, hence, we eye on writing overpriced in the money put options that are likely to reduce hedging costs of long legs.

The combination of IV 1-3m skews suggested credit put spreads that have favored to arrest ongoing upswings in short run and bearish risks are to be taken care by 3m ATM longs.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts