The US economy advanced an annualized 1.9 pct on quarter in the three months to December of 2016, lower than a 3.5 pct expansion in the previous period and below market expectations of 2.2 pct, advance estimates showed.

The deceleration in real GDP in the fourth quarter reflected a downturn in exports, an acceleration in imports, a deceleration in PCE, and a downturn in federal government spending that were partly offset by an upturn in residential fixed investment, an acceleration in private inventory investment, an upturn in state and local government spending, and an acceleration in non-residential fixed investment.

Elsewhere the detail is mostly encouraging –

The personal spending added +1.7ppts,

The business investment chipped in with a +0.3ppt addition to growth (the best in nearly 2yrs) and

The housing investment also added +0.4ppts, the highest in a year.

Private domestic demand, a better gauge of growth, came in at a decent 2.8%, broadly in line with the Fed's expectations of moderate growth.

Durable goods orders fell 0.4% in December (vs +2.5% expected), the drop mainly due to a 2.2% decline in transportation orders that defied gains in Boeing orders and vehicle assemblies.

Ex-transportation there was a 0.5% gain alongside solid equipment and shipments data that accounted for a stronger than expected report overall.

Inflation expectations (Michigan Univ.) for 5-10yrs ahead rose from December’s 2.3% record low to 2.6%, while overall consumer sentiment was revised higher.

The U.S. central bank is seen raising borrowing costs later this year given the fiscally expansive policies proposed by Donald Trump, and the new president’s agenda may help to lift wages in 2018, hoisting labor costs, the bank said in a Jan. 25 report.

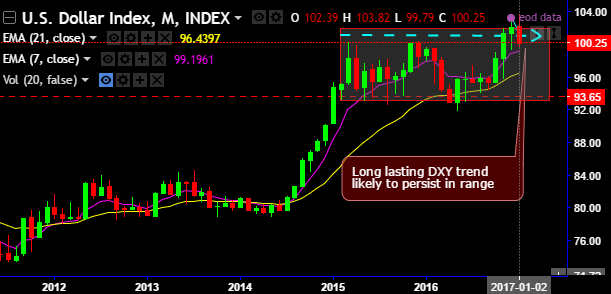

While the dollar index (DXY) seems edgy at this juncture but senses strong support at 100 marks. The dollar index trend has been oscillating between 93 and 103 range since march 2015. To our surprise there seem to be no lingering doubts as to how reliable the news we are being told by the Trump camp are.

The Japanese yen was the major gainer, with USDJPY at around 114.700 levels, while the euro and, to a lesser extent, the pound also rose against the US dollar.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market